Shouldn’t We Be Enjoying This Ride?

“Life is what happens to us while we are making other plans.”

–Allen Saunders

In our recent discussions with clients, we’ve often encouraged them to “enjoy this environment,” especially when conversations veer toward pessimism. Phrases like, “This can’t continue,” or, “How much longer can this go?” have been frequently spoken…for years. As humans, this feeling is logical but isn’t always particularly rational.

We’ve observed that, whether in bull or bear markets, worry seems to be a prevailing sentiment among investors. This constant state of anxiety persists regardless of market conditions. The year 2022, with its high volatility and disrupted trends, was understandably a cause for concern. However, with the S&P 500 this year on the brink of recording one of its best first-quarter performances since 1928, the question arises: should we be enjoying the ride?

In our view, this common theme of anxiety despite exceptional market performance illustrates the importance of systematic investing. By reducing the sway of fear and euphoria, a systematic investing process keeps focus on long-term goals and only allows decisions to be driven by strategy, not by emotion.

In this month’s Note, we examine the S&P 500’s Q1 performance, comparing it with other first quarters back to 1928. We also review how the S&P 500 fared in Q2-Q4 during years when the first quarter was notably positive. Our goal isn’t to predict the future but to highlight the strength and durability of the trend following.

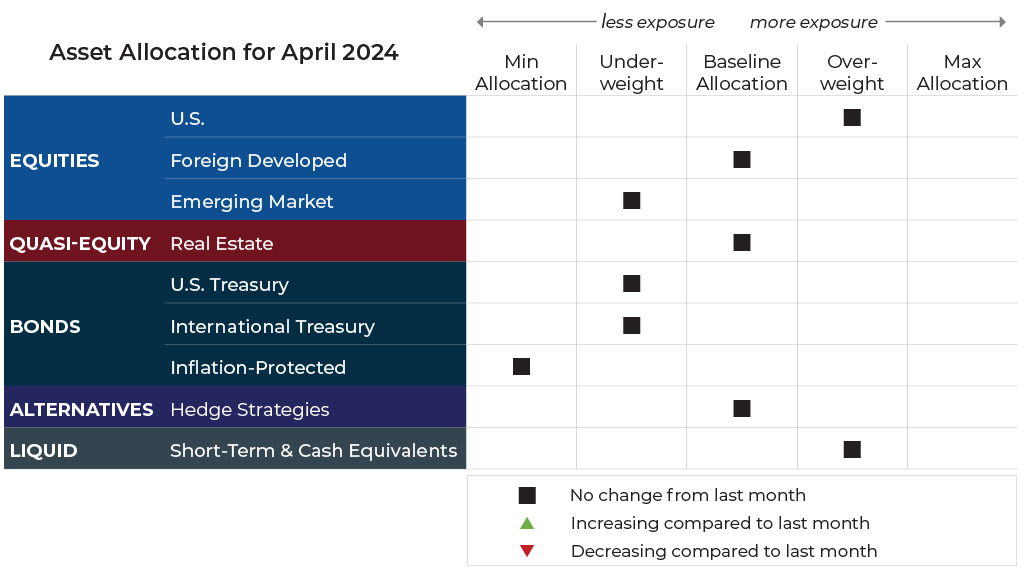

But first, here’s a summary of our response to what transpired in the markets heading into April.

Disclaimer: This note is for general update purposes related to the general strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your exposure to any given asset class will depend on your goals, risk profile, and how tactical or static your risk profile calls for. Adjustments can vary across strategies depending on each strategy’s objectives. What’s illustrated above most clearly reflects allocation adjustments for the Growth Strategy. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth, please contact your advisor.

ASSET-LEVEL OVERVIEW

Equities & Real Estate

Another month, another all-time high for the S&P 500 Index in 2024. In terms of market dynamics, growth stocks have led the rally year-to-date. Interestingly though, value, dividend, mid-, and small-cap stocks have outperformed growth stocks in March. As trend followers, our focus isn’t on the U.S. market’s breadth or the question of who is leading or lagging. We often encounter discussions about market breadth’s role in assessing market “health,” but we do not use it as a direct factor in portfolio management. Instead, we view market breadth as inherently reflected in the price trends of the assets we invest in. Therefore, based on the current price trends, Spartan portfolios will not change their broad U.S. equities allocations and will remain overweight.

Perhaps not surprisingly given the value bent, foreign developed markets have also performed relatively well in March, leading the S&P slightly. Emerging markets are also positive but continue to lag many of the other indexes. Overall, international stocks continue to be underweight in our portfolios, with a tilt toward developed equities.

As is typical, sentiment around interest rates continues to drive real estate security prices. Prices are generally unchanged for the month but trends remain positive. The overall picture for the asset class in our portfolios remains unchanged as we head into April.

Fixed Income & Alternatives

Like real estate, fixed-income investors continue to wait with bated breath for economic results around inflation and employment, while also listening closely for cues from the Federal Reserve. Data is showing inflation to be stubbornly elevated, but the Fed appears content with its plan for rate cuts this year. Prices have yo-yo’d accordingly. Perhaps as expected, trends remain mixed, with ultra-short-term Treasuries remaining the strongest in terms of price while also having some of the strongest yields. For that reason, Spartan portfolios will remain overweight on the very short end of duration and completely out of longer-duration instruments. Any intermediate-term exposure is small and under seven years.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 10/1/1928 to 3/25/2024; Barchart.com, Growth ETF Vanguard (VUG), 3/1/2024 to 3/25/2024; Barchart.com, Value ETF Vanguard (VTV), 3/1/2024 to 3/25/2024; Barchart.com, High Dividend Yield Vanguard ETF (VYM), 3/1/2024 to 3/25/2024; Barchart.com, Midcap ETF Vanguard (VO), 3/1/2024 to 3/25/2024; Barchart.com, Smallcap ETF Vanguard (VB), 3/1/2024 to 3/25/2024; Barchart.com, FTSE All-World Ex-US ETF Vanguard (VEU), 3/1/2024 to 3/25/2024; Barchart.com, 1-3 Month T-Bill Barclays Capital SPDR (BIL), 3/1/2024 to 3/25/2024; Barchart.com, 1-3 Year Treasury Bond Ishares ETF (SHY), 3/1/2024 to 3/25/2024; Barchart.com, 3-7 Year Treas Bond Ishares ETF (IEI), 3/1/2024 to 3/25/2024; Barchart.com, 20+ Year Treas Bond Ishares ETF (TLT), 3/1/2024 to 3/25/2024; and Barchart.com, Gold Trust Ishares (IAU), 3/1/2024 to 3/25/2024

Three potential catalysts for trend changes:

- No Surprise: As expected, the Federal Reserve held interest rates steady at its policy meeting that concluded on March 20, but officials still expect three rate cuts in 2024. Firmer-than-expected inflation in the first months of the year hasn’t derailed the central bank’s plans, but a stronger-than-expected growth environment has raised policymakers’ outlook for longer-term rates. Fed officials now forecast fewer rate cuts in 2025 and 2026. The longer-term “neutral” rate needed to keep the economy at full strength with steady inflation is now expected to be 2.6%, up slightly from 2.5% in December.

- No More Negatives: The nearly 12-year global experiment with negative interest rates is over. The Bank of Japan, the last holdout, has moved its key policy rate back to at least zero. The experiment revealed that negative rates weren’t enough by themselves to pull economies out of a recession or lift inflation toward the central bank’s 2% targets. A global pandemic and the start of the war in Ukraine pulled forward spending and caused shortages, which increased inflation. In Japan’s negative rates case, after a delay, it contributed to driving the yen down and import prices up, fueling the return of inflation. Despite some adverse effects, banking systems didn’t collapse as feared.

- Tough Road for New Buyers: Changes to the market for mortgage-backed securities mean the all-important 30-year mortgage rate might not decline as quickly as many hope, even if the Federal Reserve cuts interest rates later this year. Economists at Fannie Mae recently increased their forecast for average 30-year fixed mortgage rates to be 6.4% on average in Q4’24, up from their prior forecast of 5.9%. They are also expecting an average rate of 6.2% in 2025.

Sourcing for this section: The Wall Street Journal, “Fed Officials Still See Three Interest-Rate Cuts This Year, Buoying Stocks,” 3/20/2024; The Wall Street Journal, “Stock Market Today, March 20, 2024: Indexes Close at Record Highs After Fed Holds Rates Steady,” 3/20/2024; The Wall Street Journal, “Global Era of Negative Interest Rates Ends as Japan Goes to Zero,” 3/19/2024; and The Wall Street Journal, “The New Normal for Mortgage Rates Will Be Higher Than Many Hope,” 3/22/2024

The S&P 500 Is Having a Top 15 Performance in Q1

“The present is the past rolled up for action, and the past is the present unrolled for understanding.”

–Will Durant

We often say that data is our love language. So, any time the market displays behavior we think might be interesting, we love to explore it. Sometimes, that exploration results in something truly interesting, and sometimes, it turns out to be nothing meaningful.

Last year (2023) was a classic example of this. As the first half of the year closed on a tear, we wanted to see how it compared to other years with strong-performing first halves. 2023 indeed had among the best starts in the S&P 500 Index history. We also wanted to see how markets with strong first halves concluded a given calendar year under the circumstances. Looking at the data we found that an index with a strong first half of the year always ended higher than its mid-year close, never lower. This study set the stage for an interesting real-time experiment throughout the remainder of 2023, as we saw the index decline, initially on pace to finish lower then it rallied in the last 60 days and ended higher once again.

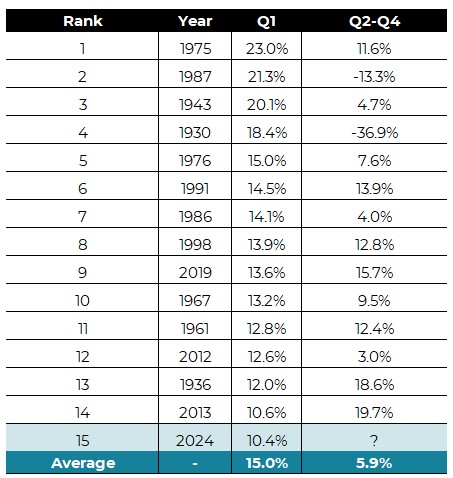

Fast-forward to 2024. Another similarly strong start has our attention. Given the fast start for the year in equity markets, we became curious about where this year’s first quarter ranks historically and what subsequent returns were produced. To examine this, we went back into our data archives and pulled out S&P 500 Total Return data going back to 1928. This near-100-year sample gives us 96 first-quarter observations to analyze.

We found that out of 96 first quarters since 1928, 2024 is at the 15th-best position, with a return of just over 10%. In case you’re wondering, the best first quarter since 1928 occurred in 1975 with the benchmark index returning a scorching 23%. The average return of this “Top 15” group is, ironically, right at 15% and the overall data set average for all Q1s is 2.5%.

Best Q1 Performance for the S&P 500

So what happens from here? Well, if you are expecting an answer other than “we don’t know,” then welcome to our typical monthly note, since you must be new here.

It probably sounds like a broken record now, but as trend followers we believe the best predictor of what a market will do is what it is doing. So with trends up and our portfolios situated as described above, our expectation is for that to continue…until the trend reverses.

That said, it can be useful to look at what has happened before, if for no other reason than to remind ourselves that anything can happen and that we should prepare to respond accordingly. For instance, the data shows that out of the top 14 (ignoring 2024) Q1s, only two finished the year lower, but boy were they biggies (1930 and 1987). With those two outliers included, the average April to December return among this top-14 group is 5.9%.

Except for 1930 and 1987, the market has generally shown consistent persistence after a strong first quarter. We suspect many would argue that enhanced market and regulatory controls instituted during the last several decades make the risk of another ’87-style crash very low. That’s probably correct, but even still, our approach to risk management would remain the same with a cautious “always-ready” mindset.

The general conclusion is that good starts usually correlate with good finishes. The beauty of a systematic investing process, in our opinion, is that, ultimately, it doesn’t matter what people think will happen later this year.

With prices trending higher and volatility remaining low, we think investors should enjoy these periods and stop worrying about what may happen next. For clients who partner with Spartan, we believe this is particularly true since our strategies stand ready to trigger action as prices dictate.

Sourcing for this section: GFD, SPDR S&P 500 ETF Trust (SPY), 2/1/1993 to 7/26/2023; and ICE, S&P 500 TR, 10/1/1928 to 3/25/2024

Sincerely,

The Spartan Team