Resilience Is the Goal; Perfection Is Not

In investing, the allure of certainty can be hard to resist. When parts of a portfolio underperform in the short term, the urge to abandon them grows, driven by a desire to focus solely on what’s working. But this desire often leads investors away from the principles of diversification — principles designed to build resilience over time, not deliver comfort in the moment.

Behavioral psychology helps explain why.

Recency bias, our tendency to overemphasize recent outcomes, tempts us to double down on short-term winners while discarding slower-moving assets. This instinct is natural but can be dangerous. It ignores the fact that markets are dynamic, and today’s laggards can often become tomorrow’s leaders.

For trend followers, diversification is non-negotiable. A systematic, data-driven approach can be used to allocate across markets — knowing that not every position will perform at the same time. This discipline ensures the portfolio is ready for whatever comes next, even if it means enduring temporary discomfort.

Resilience, not perfection, is the goal.

A well-diversified portfolio isn’t built to make every position shine in every market. It’s built to adapt. This means accepting the ebb and flow of performance without second-guessing the process. When diversification feels frustrating, it’s worth remembering that resilience comes from sticking to the plan and not reacting to short-term noise.

As the year draws to a close, predictions about what’s ahead will swirl. Inevitably, many will miss the mark. That’s why we focus on a systematic approach, allowing markets — not opinions — to guide us. While systematic trend following isn’t immune to challenges, its emphasis on discipline and adaptability has repeatedly demonstrated value in helping navigate uncertainty.

In this Investment Update, we explore how diversification and discipline shaped our approach in another year of unexpected twists and turns.

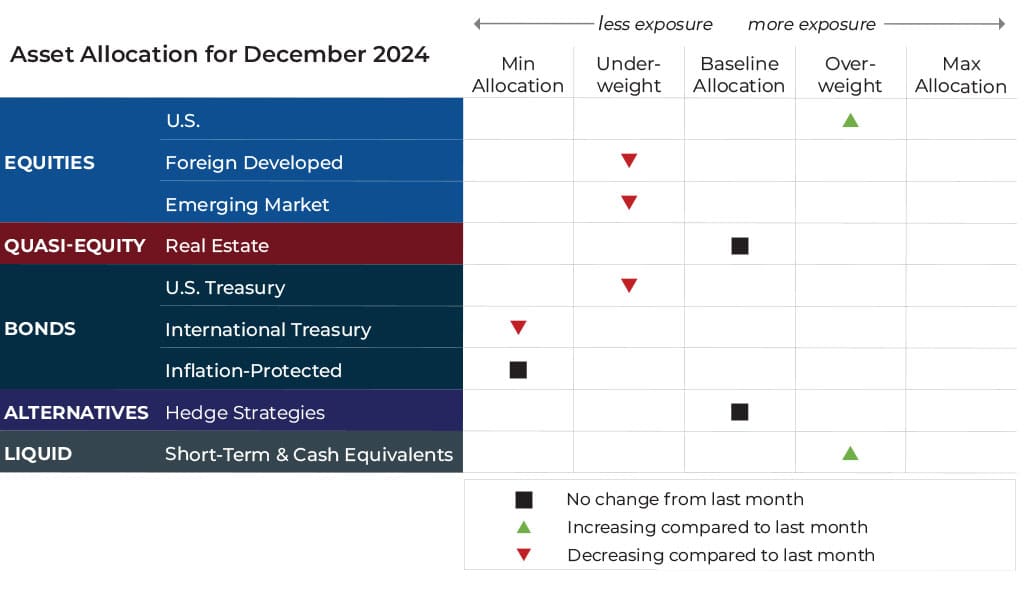

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for December.

Disclaimer: This note is for general update purposes related to the general strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your exposure to any given asset class will depend on your goals, risk profile, and how tactical or static your risk profile calls for. Adjustments can vary across strategies depending on each strategy’s objectives. What’s illustrated above most clearly reflects allocation adjustments for the Growth Strategy. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth, please contact your advisor.

ASSET-LEVEL OVERVIEW

Asset-Level Overview

Equities & Real Estate

Despite the risk of higher volatility due to a contentious U.S. election and escalation in the Middle East and Ukraine, U.S. stocks continued to march higher with low volatility in November. Large caps remain the strongest segment year to date, but the monthly increases were broad, with mid and small caps leading the way. All segments remain in textbook uptrends as we move into the final month of 2024.

While the promise of “America First” policies under the new presidential regime boosted U.S. stocks, international stocks were not so fortunate. Both developed and emerging markets have now crossed into downtrend territory over the intermediate term, meaning that exposure will decrease. These vacated allocations will move to the stronger U.S. equity segment, leaving international underweight relative to the U.S.

The interest rate forecast remains murky, with inflation mostly moving lower but the economy remaining strong. A smaller rate cut in November kept the landscape accommodating for real estate securities. However, this could be short-lived if data provides an obstacle to further reductions in interest rates in 2025. For now, real estate trends are positive, and allocations remain at the baseline.

Fixed Income & Alternatives

The retracement in bond prices that began in October continued in November. After steadily increasing exposure to higher-duration bonds during the late summer months, we have nearly unwound all those trades. We are fond of pointing out that this is a feature rather than a bug of trend following. These false positives have not materially impacted overall portfolio performance and have provided valuable tax-loss harvesting opportunities for taxable accounts.

The shorter end of the yield curve remains strong and will continue to take on exposure from weaker fixed-income segments while equities drive performance.

In the alternatives allocation of our portfolios, we maintain a primary exposure to fixed income. We are increasingly favoring corporate bonds while reducing exposure to long-duration Treasuries. The equity sector is hedged, predominantly favoring long positions alongside selective shorts. Additionally, our commodities exposure also remains net long.

Three potential catalysts for trend changes:

-

Economic Surveys: U.S. economic activity continued to expand this month as confidence among U.S. businesses boomed following the election. The S&P Global Flash U.S. Composite PMI measures activity in the manufacturing and services sectors. It increased to 55.3 in November, up from 54.1 the prior month. That speeds up a previously increasing trend, indicating that activity is expanding at the fastest rate in about two and a half years. The services sector continued to be the only measure higher than 50, indicating expansion. The manufacturing industry contracted at its slowest rate in four months, suggesting a recovery could be in the cards in the months ahead. In fact, manufacturing sentiment achieved its most favorable level in two and a half years.

-

Tariff Talks: China’s share of U.S. imports declined to around 14% in 2023. This compares to about 22% in 2017. However, rising tariffs between the U.S. and China have done little to lower the overall U.S. trade deficit in global trade or China’s overall trade surplus with the United States. The trade imbalance is driven by strong demand by consumers in America and weakening domestic Chinese demand.

-

Home Buying: Sales of existing homes rose in October, which reflects a brief drop in mortgage rates. The short-lived rate decline improved affordability for buyers and generated the first year-over-year gain in sales in more than three years. A 30-year fixed mortgage decreased throughout the summer and reached a two-year low in late September. “People are accepting that the mortgage rates, the new normal, is not going to be 3% or 4% or 5%,” said Lawrence Yun, the chief economist at National Association of Realtors. Overall, home sales in 2024 are still on track to be the lowest level since 1995.

Sourcing for this section: The Wall Street Journal, “U.S. Private Sector Activity Picks Up Pace as Firms Look Forward to a New Government,” 11/22/2024; Tradingeconomics.com, United States ISM Services PMI, 11/26/2024; Tradingeconomics.com, United States ISM Manufacturing PMI, 11/26/2025; The Wall Street Journal, “American Companies Are Stocking Up to Get Ahead of Trump’s China Tariffs,” 11/20/2024; and The Wall Street Journal, “Home Sales Rose in October Following Decline in Mortgage Rates, 11/21/2024

We are so grateful for our clients and partners. We wish you and your families a very happy holiday season!

Sincerely,

The Spartan Team

Disclaimer: this note is for general update purposes related to the strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your particular exposure to any given asset class will depend on your goals, risk profile, and how tactical or passive your risk profile calls for. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth please contact your advisor. This email and the data herein is not a solicitation to invest in any investment product nor is it intended to provide investment advice. It is intended for information purposes only and should be used by investment professionals and investors who are knowledgeable of the risks involved. No representation is made that any investment will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses. While every effort has been made to provide data from sources considered to be reliable, no guarantee of accuracy is given. Historical data are presented for informational purposes only. Investment programs described herein contain significant risks. A secondary market may not exist or develop for some investments portrayed. Past performance is not indicative of future performance. Investment decisions should be made based on the investors specific financial needs and objectives, goals, time horizon, tax liability, risk tolerance and other relevant factors. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Investors should consider the underlying funds’ investment objectives, risks, charges and expenses carefully before investing. The Advisor’s ADV, which contains this and other important information, should be read carefully before investing. ETFs trade like stocks and may trade for less than their net asset value. Spartan Planning Group, LLC (“Spartan” or the “Advisor”) is registered as an investment adviser with the United States Securities and Exchange Commission (SEC). Registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the Adviser has attained a particular level of skill or ability. Indexes are unmanaged and do not incur management fees, costs, and expenses. Spartan’s risk-management process includes an effort to monitor and manage risk, but should not be confused with and does not imply low risk or the ability to control risk. There are risks associated with any investment approach, and Spartan strategies have their own set of risks to be aware of. First, there are the risks associated with the long-term strategic holdings for each of the strategies. The more aggressive the Spartan strategy selected, the more likely the strategy will contain larger weights in riskier asset classes, such as equities. Second, there are distinct risks associated with Spartan Strategies’ shorter-term tactical allocations, which can result in more concentration towards a certain asset class or classes. This introduces the risk that Spartan could be on the wrong side of a tactical overweight, thus resulting in a drag on overall performance or loss of principal. International investments may involve additional risks, which could include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks. Diversification strategies do not ensure a profit and do not protect against losses in declining markets.