The Impact of Short-Term, Incremental Improvements on Long-Term Success

“You can’t connect the dots looking forward; you can only connect them looking backward”

–Steve Jobs

During numerous discussions with clients in recent months, the notion of “all-time highs” has surfaced. Often, these highs are perceived as a harbinger of downturns. However, we believe the evidence points to a contrary conclusion.

In January, we saw the S&P 500 achieve four all-time highs, surpassing the previous peak from January 2022. In the context of market history, a few years may seem minor, but enduring 512 days beneath the previous all-time high can be challenging for investors psychologically and behaviorally.

Since 2013, a period widely recognized as a great time for stocks in the U.S., the S&P 500 notched 351 all time highs (ATHs). This tally spans a broad range, from the 70 highs in 2021 to just one in 2022 and none in 2023. This is a stark contrast against the period from 1930 to 1953, which saw no new highs. To put it differently, the ATH from 1929 stood unchallenged until 1954! Could the absence of ATHs be the actual omen of tougher times ahead?

Our analysis, viewed through the lens of trend following, suggests that trends, whether ascending or descending, have inertia and tend to perpetuate themselves. That said, sometimes the investor’s cries of “but this time is different” proves to be accurate, and during these times, we rely on trend data and pre-determined exit strategies to remove exposure, allowing us to live and fight another day.

In this month’s Note, we discuss how small improvements over time can lead to big results in the long term.

But first, here’s a summary of our take on what transpired in the markets in January.

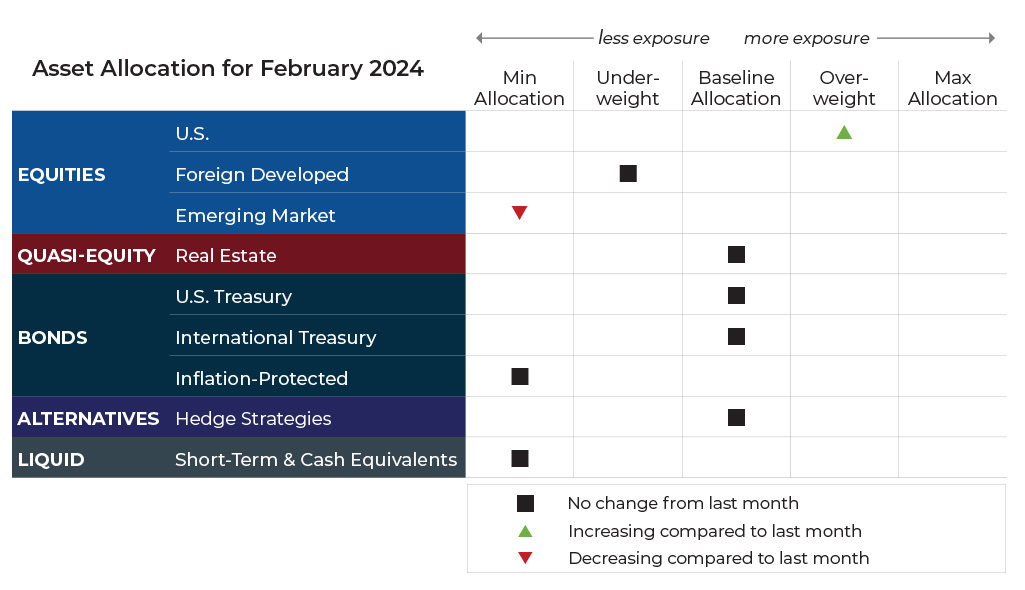

Disclaimer: This note is for general update purposes related to the general strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your exposure to any given asset class will depend on your goals, risk profile, and how tactical or static your risk profile calls for. Adjustments can vary across strategies depending on each strategy’s objectives. What’s illustrated above most clearly reflects allocation adjustments for the Growth Strategy. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth, please contact your advisor.

ASSET-LEVEL OVERVIEW

Equities & Real Estate

For the S&P 500 Index, 2024 began the way 2023 ended, with the largest technology and growth companies rallying. The moves were enough to push the benchmark large-cap index to a new all-time high for the first time since the opening trading day of 2022. As was typical during 2023, other market segments lagged: value, dividend, mid, and small caps. The latter two have struggled even to hit positive territory as the month ended. For February, our portfolios will generally see a slight increase in U.S. equities as they take on exposure from weaker international equities, as explained below.

Foreign equities have lagged their U.S. large-cap counterparts. In developed economies, monthly losses appear to be imminent. In emerging economies, things are even more bleak, with economic weakness in China continuing to drag EM equity assets lower. Allocations to emerging market equities in our portfolios will return to their minimum due to downtrends over all meaningful timeframes.

Real estate securities paused their rally, coinciding with talk of peak interest rates, while declining for the first time since October. Despite some losses in January, the overall picture for the asset class has not changed as the upward trend continues. However, another month of declines could be enough to move allocations from baseline to underweight.

Fixed Income & Alternatives

Similar to real estate, fixed income generally experienced retracements in January as market sentiment about the timing of rate decreases shifted out a bit further. From a price perspective, the strongest areas of the yield curve continued to be on the short end, with longer-duration bonds being the weakest. International Treasuries and inflation-protected bonds performed virtually in lockstep. Allocations in our portfolios will not change, but trends could easily shift in the coming months, particularly for longer-duration bonds.

Like most assets with the exception of U.S. large-cap equities, gold prices were down in January, but larger trends continue to be positive as January ends. As a result, exposure in our portfolios will not change and will remain at the baseline allocation.

Sourcing for this section: ICE, S&P 500, 1/1/2021 to 1/29/2024; Barchart.com, Midcap ETF Vanguard (VO), 1/1/2024 to 1/26/2024; Barchart.com, Smallcap ETF Vanguard (VB), 1/1/2024 to 1/26/2024; Barchart.com, Real Estate Vanguard ETF (VNQ), 1/1/2023 to 1/29/2024; Barchart.com, 1-3 Year Treasury Bond Ishares ETF (SHY), 1/1/2024 to 1/26/2024; Barchart.com, 3-7 Year Treas Bond Ishares ETF (IEI), 1/1/2024 to 1/26/2024; and Barchart.com, 20+ Year Treas Bond Ishares ETF (TLT), 1/1/2024 to 1/26/2024

Three potential catalysts for trend changes:

- Strong GDP: The recession forecasted by many economists never showed up in 2023. American consumers made sure of it. During the past year, the U.S. economy grew 3.1%, encompassing seasonally- and inflation-adjusted 3.3% pace during Q4. A resilient labor market supported strong consumer spending and helped avert a downturn.

- Labor Supply/Demand: Many workers came off the sidelines to join the labor force in 2022 and 2023, which eased labor shortages and put downward pressure on wage growth. However, additional gains may be difficult to achieve. This is important because inflation remains above the Fed’s 2% target, even though we saw a significant retreat last year. The participation rate, which is the share of Americans in the labor force, has remained steady since August. If labor supply does not increase, the fight against inflation might require easing demand or weaker growth.

- Credit Issues: Consumers are putting more purchases on credit cards and taking longer to pay them off. The four biggest banks in the U.S. reported higher credit card spending in 2023 versus the previous year. Unpaid balances surpassed 2019 levels for the first time, an indication consumers are putting more on their credit cards and taking longer to pay off their bills than they did before the pandemic. Additionally, delinquency rates have continued to slowly rise since 2021.

Sourcing for this section: The Wall Street Journal, “What Recession? Growth Ended Up Accelerating in 2023,” 1/25/2024; and The Wall Street Journal, “Labor Supply Helped Tame Inflation. It Might Not Have Much More to Give.” 1/21/2024

Consistency Compounds

“Plans are nothing, planning is everything.”

–Dwight D. Eisenhower

January is commonly a time of resolutions and goal setting for society at large, as well as Spartan Planning Group. For us, it’s not about resolving to do something better out of frustration over failed expectations. Instead, it is part of a thoughtful, systematic process for running our business and delivering value to our clients.

Our firm’s systematic approach toward achieving goals aligns with one of our main tenets: “It’s better to be consistently good than occasionally great.”

This saying can take on a variety of applications. One meaning we favor is that it is better to repeatedly execute seeking small benefits that stack over time rather than looking for a shortcut to success. To use a sports analogy, we would prefer to consistently deliver base hits and doubles in most of our at-bats, than just occasionally hit a home run with nearly all strikeouts in between. So, how does this relate to the markets and client portfolios? In our view, we’re now seeing the long-term fruits of our systematic approach to making allocation decisions. Meb Faber, a fellow trend follower, recently noted that, since 1950, most of the outperformance of U.S. equities over their global counterparts has occurred since 2009.

Spartan Planning Group portfolios have generally been tilted in favor of U.S. equities relative to international. The performance benefits created by these deployments of capital are minor when evaluated over the short term. However, consistently overweighting U.S. equities over the long term has, we believe, allowed us to steadily reap harvests which can compound in a big way over time.

Coupling those rewards with the fact that they are produced in a way that is dispassionate and unemotional should be comforting for our clients, who are trying to reach their goals without any knowledge of what the next 30-40 years will look like (or even the next 12 months).

In our experience, delivering “consistently good” rather than “occasionally great” has helped us guide your financial lives well over the years.

In 2024, our only resolution is to continue consistently executing the systems that have gotten us to this point while looking for ways to expand systematic thinking into new areas that add value to your life.

Sincerely,

The Spartan Team