2024 Was A Tale of Two Halves

“Do not pray for an easy life, pray for the strength to endure a difficult one.” – Bruce Lee

It’s easy to stay disciplined when things are going smoothly. When markets rise steadily and portfolios deliver consistent gains, the urge to deviate from the plan feels almost nonexistent. But discipline is truly tested when the tide shifts and moments of uncertainty creep in.

The irony of easier times is that they can dull our readiness for challenges. When the path has been smooth, it’s human nature to expect more of the same — to relax the guardrails and let emotions sneak into decision-making.

Yet, resilience in investing, as in life, is built not during the good times but in how we prepare for and respond to the hard ones.

As 2025 begins to unfold, it’s worth reflecting on how quickly conditions can shift. A year of strong trends can easily be followed by stretches that test patience. It’s in those moments of doubt, discomfort, and even frustration that the value of a systematic, long-term plan becomes most apparent. While the temptation to chase quick fixes or abandon time-tested processes may arise, those who endure with discipline often find themselves better positioned when conditions turn again.

In this month’s post, we reflect on how sticking to a disciplined, systematic process through both easy and challenging market conditions builds resilience over time. By revisiting the “tale of two markets” from 2024 — where fortunes varied dramatically between the first and second halves of the year — we explore how short-term fluctuations can test resolve but ultimately reinforce the value of long-term commitment. The lessons learned serve as a reminder that successful investing isn’t about avoiding volatility but about enduring it with discipline.

But first, here’s a summary of our take on what transpired in the markets in January.

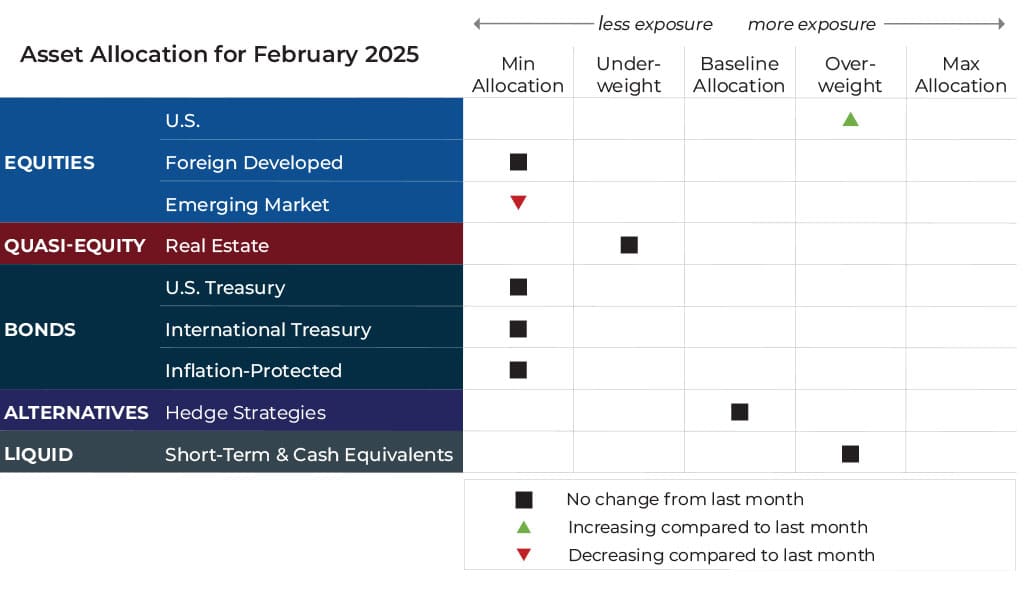

Disclaimer: This note is for general update purposes related to the general strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your exposure to any given asset class will depend on your goals, risk profile, and how tactical or static your risk profile calls for. Adjustments can vary across strategies depending on each strategy’s objectives. What’s illustrated above most clearly reflects allocation adjustments for the Growth Strategy. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth, please contact your advisor.

Asset-Level Overview

Equities & Real Estate

The relatively weak close to 2024 gave way to a great start in 2025, as all major segments of U.S. equities rose in January. The renewed rally coincided with another new all-time high in the S&P 500 Index, its first since early December. As expected, trends over all timeframes remain positive, which is leading allocations in our portfolios to overweight due to continuing to hold exposure previously vacated by other equity segments, such as international and real estate.

Speaking of international equities, exposure has been underweight for much of the last year or so as foreign developed and emerging market stocks have lagged versus U.S. This divergence will continue in our portfolios in February, as emerging markets has joined developed markets in downtrends across all timeframes. This exposure will make its way to U.S. equities for at least the next month.

Real estate continues to mimic international equities in its relative weakness versus the U.S., and with its mix of an intermediate-term downtrend with long-term uptrend. Also like international, the vacated exposure remains “handed up” to the U.S. while we wait and see what will happen in real estate. The next move in interest rates remains the biggest driver. In the meantime, exposure will continue to be underweight.

Fixed Income & Alternatives

The change in interest rate expectations from late 2024 continues to impact bond markets by keeping prices from climbing higher. Uncertainty over the new presidential administration, specifically as it relates to tariffs, has also kept fixed income in a sideways to down pattern. Until some clarity or perceived clarity arrives, these conditions are unlikely to change. From a trend-following perspective, trends are simply down, meaning exposures to these assets will be at their minimum with ultra-short-term bonds mimicking Treasury bills being the preferred destination.

In the alternatives allocation of our portfolios, the largest exposure remains tilted toward the fixed income sector. Like the non-alternative fixed income allocation, the portfolio favors long positions in short-duration government bonds. The equity sector is predominantly hedged but retains a net long position, with most of its long exposure focused in the U.S. Additionally, commodities exposure continues to hold a net long position. Currencies, particularly those pegged against the U.S. Dollar, are now a meaningful short position in the portfolio.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 12/1/2024 to 1/20/2024

Three potential catalysts for Trend Changes:

-

Year-End GDP: U.S. gross domestic product, which is the value of all goods and services produced across the economy, grew 2.5% in 2024. That was slower than the 3.2% in 2023 but is generally still considered a constructive pace, considering economic issues loomed large during 2024 and were highlighted during the election, when data largely showed a strong economy but many everyday Americans disagreed. The Fed predicts that the economy will grow 2.1% in 2025 and 1.8% in the longer run.

-

Strong Spending: Spending on personal consumption rose at a 4.2% annualized pace between October and December last year. This represents the fastest quarterly growth rate since early 2023. The quarterly increase closed a strong year of spending by American households, which helped the economy weather the transition out of the post-pandemic inflation surge. Despite a softer labor market and still-elevated inflation, a combination many analysts thought would leave the economy vulnerable to weakening, growth in individual shopping spanned the goods and services sectors.

-

Standstill Fed: The Federal Reserve has hit pause on recent interest rate cuts and entered a new wait-and-see mode, as it tries to determine whether and how much more to lower rates from their recent two-decade high. The decision on January 29 to leave the benchmark federal-funds rate at its current range straddling 4.25% was preceded by three consecutive rate cuts beginning in September, when the rate stood at 5.25%. Fed Chair Jerome Powell said that interest rates are now “significantly less restrictive” than they were before last year’s cuts, so “we do not need to be in a hurry to adjust our policy stance.”

Sourcing for this section: The Wall Street Journal, “U.S. GDP Grew 2.5% in 2024, but Slowed Slightly in Final Quarter,” 1/30/2025/ The Wall Street Journal, “Shoppers Keep Powering U.S. Growth,” 1/30/2025; and The Wall Street Journal, “Fed Stands Pat on Rates, Entering New Wait-and-See Phase,” 1/29/2025

Ignore the Short Term If Your Timeframe is Long

“Discipline is choosing between what you want now and what you want most.” – Abraham Lincoln

Experience and a long-term perspective makes it easier to look past short-term returns, whereas many investors are generally conditioned to overemphasize short-term performance. This effect is exacerbated if the investor is new to a particular investment philosophy, such as trend following. The result is that a stretch of performance that we ignore or even believe is great, may be viewed less favorably by others.

New investors enter our strategies on a continual basis. We are grateful this is the case and never take it for granted. This also means that depending on the arbitrary time in which an investor begins with our strategies, we are continually helping them move their gaze from short-term performance to that which is more aligned with their goals.

As we enter February 2025, 2024 begins to feel like ancient investment history to some, but we would like to revisit it one last time to illustrate the points above. By all accounts, 2024 was a great year for our strategies. We executed our rules on time and in a disciplined manner. Trends persisted in such a way that we were able to surpass our targets based on the underlying conditions. Every strategy experienced what we would consider above-average returns for the year.

With that said, 2024 in many ways broke down into a tale of two markets:

- Clients around for the whole year experienced the aforementioned above-average return.

- However, clients who started within the year may have gone nowhere.

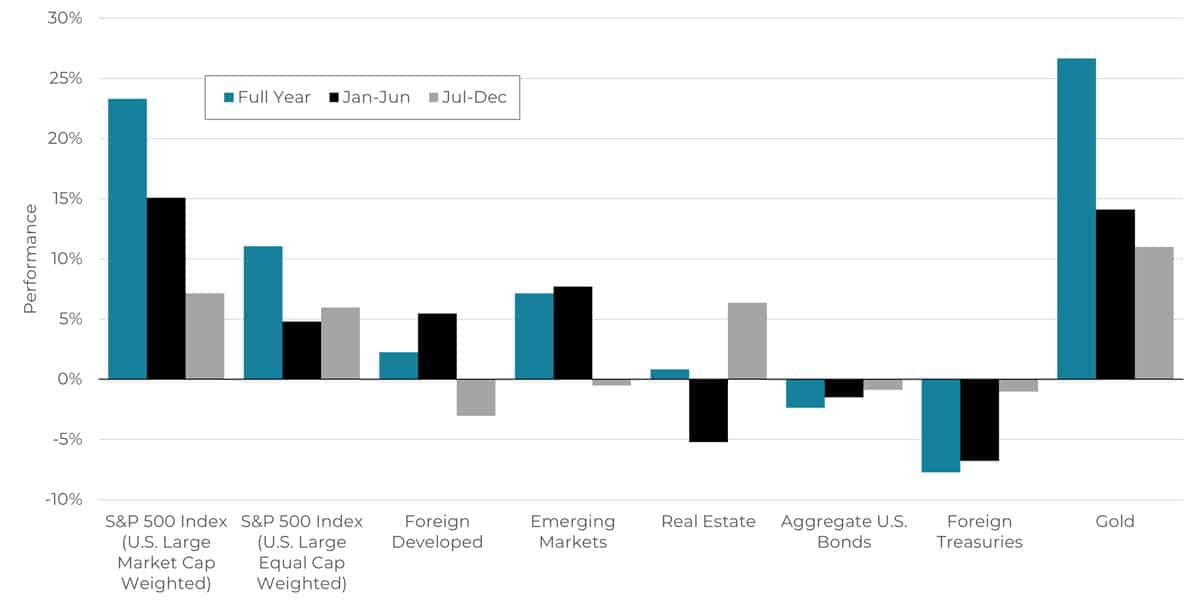

For example, below is a chart showing the performance of several major asset classes broken down by:

- Full year 2024

- First half (January to June)

- Second half (July to December)

Source: Intercontinental Exchange, 1/1/2024 to 12/31/2024

A few items to highlight:

- Two-thirds of U.S. Large Market Cap Weighted performance was generated during the first half of the year.

- The U.S. Large Market Cap Weighted performance was more than double that of U.S. Large Equal Cap Weighted, which highlights disparity between a handful of top names and everyone else.

- All other assets, other than gold, experienced mediocre or subpar returns for the year, with international stocks and fixed income being negative in the second half.

However, it wasn’t only international stocks and global fixed income that experienced poor third and fourth quarters. Even some bellwether U.S. stocks experienced a Jekyll and Hyde 2024. For example, Microsoft raced to a near 20% return by the end of June but declined about 5% during the second half of the year. Even NVIDIA, with all its hoopla in 2024, only returned around 8% for the final six months after an astounding 150% in the first half!

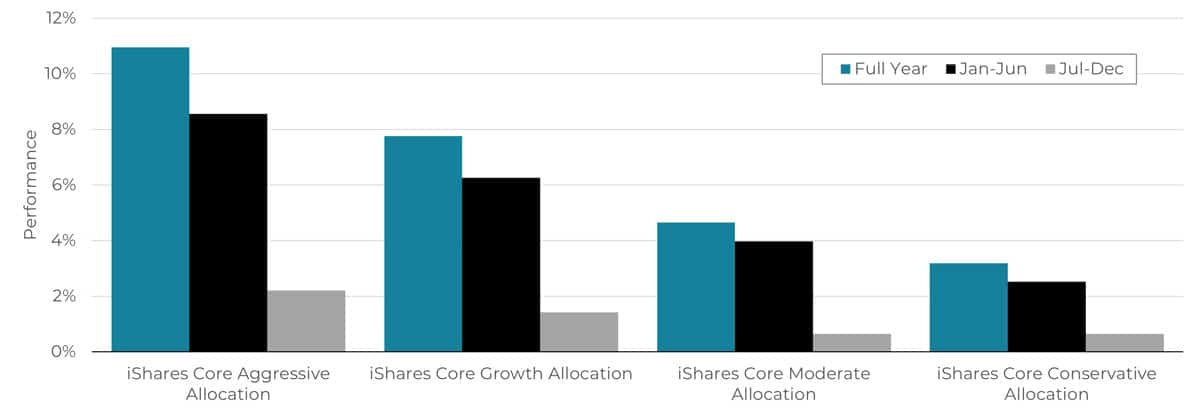

Let’s take the tale of two halves story a step further and consider how the performance of asset classes like those in the visual above impacted diversified portfolios vis-à-vis the iShares Core Allocation ETFs.

Source: Intercontinental Exchange, 1/1/2024 to 12/31/2024

As is evident, the vast majority of positive returns were generated in the first half of 2024. This means investors who made big strategy changes or invested large sums in the summer may have been disappointed with their performance if they’re using the S&P 500’s full-year return as a benchmark and not considering the context of how the two halves performed.

A Short-Term Strategy Applied to a Long-Term Horizon Can Kill You

A weight-loss analogy might be helpful here. Embarking on a weight-loss journey begins with setting a goal, but the goal depends on the timeframe.

For example, a professional fighter may have a short-term goal and go to extreme lengths to “make weight” or get below a certain point to meet the contractual demands of a particular fight. It’s not unheard of for a fighter to cut 25 pounds in the matter of days! This likely means completely foregoing food and other drastic measures to empty the body of all fluid leading up to the official weigh-in.

If the goal is to lose weight in a very short amount of time, then the best strategy may be to not eat. What about losing weight over three months, when not eating isn’t realistic? Or how about over five years? Thirty years? As should be apparent, the strategy that is best for losing weight over the short term is not the best strategy for the long term. In fact, applying a strategy meant for the short term could kill you!

The same is true of investing, in our opinion.

While this may sound like hyperbole, we believe it reflects how Spartan Planning Group intentionally ignores day-to-day performance. We believe trend following is the best way to improve odds for clients reaching LONG-TERM goals, and every rule of our process is programmed accordingly. It often doesn’t take long for clients to see the benefits, but it can indeed take some time, with late 2024 being an example.

In our opinion, the key questions for investors are:

- What has the process produced over the long term?

- Is my asset manager continuing to execute with that timeframe in mind?

We believe the data provides a favorable answer to the first question, and we are certain of the second. We hope this can give our clients confidence as we officially close the book on 2024 and continue forward in 2025.

Sourcing for this section: Barchart.com, Microsoft Corp (MSFT), 1/1/2024 to 12/31/2024 and Barchart.com, Nvidia Corp (NVDA), 1/1/2024 to 12/31/2024

Disclaimer: this note is for general update purposes related to the strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your particular exposure to any given asset class will depend on your goals, risk profile, and how tactical or passive your risk profile calls for. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth please contact your advisor. This email and the data herein is not a solicitation to invest in any investment product nor is it intended to provide investment advice. It is intended for information purposes only and should be used by investment professionals and investors who are knowledgeable of the risks involved. No representation is made that any investment will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses. While every effort has been made to provide data from sources considered to be reliable, no guarantee of accuracy is given. Historical data are presented for informational purposes only. Investment programs described herein contain significant risks. A secondary market may not exist or develop for some investments portrayed. Past performance is not indicative of future performance. Investment decisions should be made based on the investors specific financial needs and objectives, goals, time horizon, tax liability, risk tolerance and other relevant factors. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Investors should consider the underlying funds’ investment objectives, risks, charges and expenses carefully before investing. The Advisor’s ADV, which contains this and other important information, should be read carefully before investing. ETFs trade like stocks and may trade for less than their net asset value. Spartan Planning Group, LLC (“Spartan” or the “Advisor”) is registered as an investment adviser with the United States Securities and Exchange Commission (SEC). Registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the Adviser has attained a particular level of skill or ability. Indexes are unmanaged and do not incur management fees, costs, and expenses. Spartan’s risk-management process includes an effort to monitor and manage risk, but should not be confused with and does not imply low risk or the ability to control risk. There are risks associated with any investment approach, and Spartan strategies have their own set of risks to be aware of. First, there are the risks associated with the long-term strategic holdings for each of the strategies. The more aggressive the Spartan strategy selected, the more likely the strategy will contain larger weights in riskier asset classes, such as equities. Second, there are distinct risks associated with Spartan Strategies’ shorter-term tactical allocations, which can result in more concentration towards a certain asset class or classes. This introduces the risk that Spartan could be on the wrong side of a tactical overweight, thus resulting in a drag on overall performance or loss of principal. International investments may involve additional risks, which could include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks. Diversification strategies do not ensure a profit and do not protect against losses in declining markets.