Oh Come, All Ye 2024 Predictions!

“The future ain’t what it used to be.”

–Yogi Berra

It’s a joyous time of the year. Many children are writing thank you notes to Santa for making their Christmas dreams come true. People are celebrating the coming of the New Year, and firms like ours are enjoying seeing all the 2024 market predictions shared in financial services media and by other asset managers.

At Spartan Planning Group, we love predictions. Not to make them, but simply to observe the often absurd nature of other professionals in our industry.

In this month’s note, we discuss how predictions can be dangerous because they create fertile ground for making emotional investment decisions by justifying them intellectually. We also share why we feel so strongly about flipping that order on its head – to start from an intellectual standpoint and leave the emotions to the wayside.

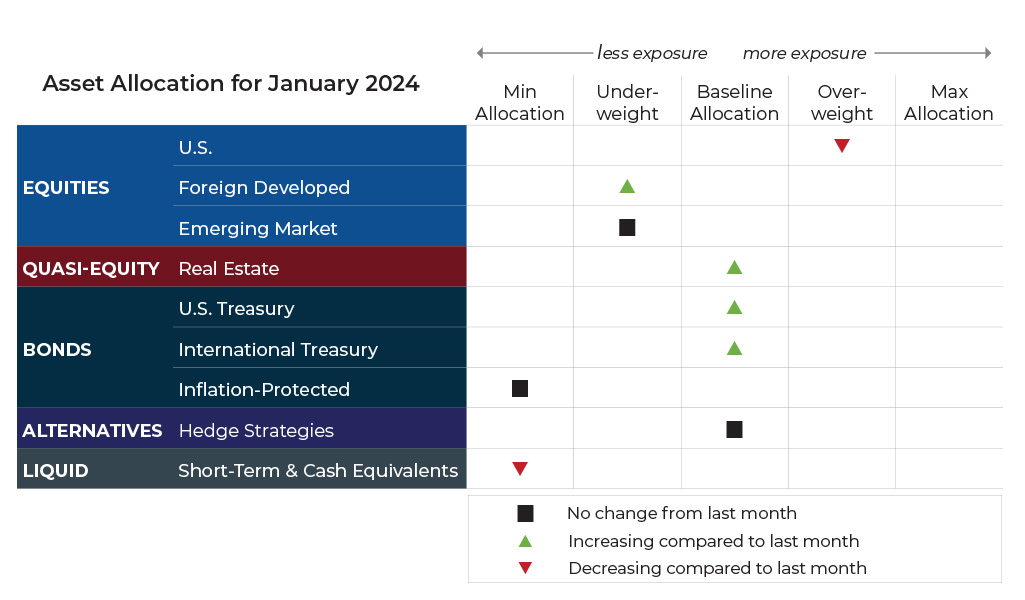

Below are the asset classes utilized in our portfolios and their model-driven exposure heading into the new year.

Disclaimer: This note is for general update purposes related to the general strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your exposure to any given asset class will depend on your goals, risk profile, and how tactical or static your risk profile calls for. Adjustments can vary across strategies depending on each strategy’s objectives. What’s illustrated above most clearly reflects allocation adjustments for the Growth Strategy. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth, please contact your advisor.

ASSET-LEVEL OVERVIEW

Equities & Real Estate

The recent rally started in late October 2023 and continued in December. U.S. indexes pushed to new yearly highs and were poised to challenge new all-time highs as the year concluded. The fourth quarter push in stocks has seen the S&P 500 Index return a whopping 15% since the October 27 low. Increases continue to be both strong and broad, with every major cap size and style benefiting. Even value and dividend stocks, which lagged significantly in 2023, have managed to produce positive returns for the year. Equity returns in the U.S. are on the verge of being generally above average, even if the road was not always easy or widespread. Given all the negative sentiment throughout 2023, we think this should be a lesson for investors to trust the trends.

Internationally, returns were a bit more mixed in December. Foreign-developed equities generated a modest gain to finish up double-digits. However, emerging markets lagged due to underperformance among Chinese equities, which are the largest component of emerging markets. China’s equity markets are making new 2023 lows as the year ends, which is a bad sign given it’s such an outlier versus so many other bullish equity markets globally.

Few assets have benefited more from the impending dovish stance of the Fed than real estate. With interest rates theoretically at a peak for now, real estate assets have seemingly troughed and managed to turn persistent downtrends into budding uptrends. The result is that Spartan Planning portfolios will move back toward baseline allocations for the first time in almost two years.

Fixed Income & Alternatives

Just as short-duration fixed income was becoming the hottest investment trend since crypto, rate pressure has eased and pushed bond prices higher to leave short-duration returns in the dust. Almost no one would argue that equity returns since the end of October have been anything but extraordinary, but did you know that long-term bonds have been even better? As mentioned earlier, the S&P 500 Index has produced a 15% increase during that span. The 20+ Year Treasury Bond Ishares ETF (TLT) has returned almost 19% in that same time. The emergence of uptrends across fixed-income instruments will cause us to increase exposure.

Gold prices have also joined the party, surviving a minor dip in December to produce a new 2023 high closing price. Trends continue to be positive as the year ends. As a result, exposure in our portfolios will not change and will remain at its baseline allocation.

Sourcing for this section: Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 1/1/1980 to 12/26/2023; Barchart.com, Dow Jones U.S. Index ($DUSA), 8/1/2006 to 12/26/2023; Barchart.com, Nasdaq QQQ Invesco ETF (QQQ), 3/1/1999 to 12/26/2023; Barchart.com, “China Largecap Ishares ETF (FXI), 1/1/2023 to 12/26/2023; Barchart.com, 20+ Year Treas Bond Ishares ETF (TLT), 10/1/2023 to 12/26/2023; and Barchart.com, Gold Trust Ishares (IAU), 1/1/2023 to 12/26/2023

Three potential catalysts for trend changes:

- Soft Landing Imminent?: The personal-consumption expenditures (PCE) price index, which is the Fed’s preferred inflation measure, fell 0.1% in November from the previous month. This marked the first decline since mid-2020. Prices were up 2.6% year over year, which is close to the 2% target set by the Federal Reserve for annual price increases.

- Spending and Hiring: Consumer spending was up 0.2% for November, higher than the 0.1% increase in October. It is an increasing sign of confidence in the economy from American households. Additionally, the labor participation rate for workers between 25 and 54 is rising to near the highest rate in more than 20 years. Ideally, this should make it easier for employers to find workers, which should prevent wages from increasing so fast that they put upward pressure on broader inflation.

- Housing Turnaround: Mortgage rates have dropped to the lowest level since June. The average rate for a standard 30-year fixed mortgage declined about a quarter percentage point to 6.67%, according to Freddie Mac. Rates are down more than a full percentage point from their recent peak near 8% this fall. Coincidentally, home sales moved up from 13-year lows in November. Existing home sales, which comprise most of the housing market, increased 0.8% in November from the prior month, as reported by the National Association of Realtors.

Sourcing for this section: The Wall Street Journal, “Prices Fell in November for the First Time Since 2020. Inflation Is Approaching Fed Target.” 12/22/2023; The Wall Street Journal, “Mortgage Rates Fall To 6-Month Low,” 12/21/2023; and The Wall Street Journal, “Home Sales Ticked Up in November After 5 Months of Declines,” 12/20/2023

Don’t Make Investment Decisions Emotionally, Then Justify Them Intellectually

“The essence of strategy is choosing what not to do.”

–Michael Porter

In a Note from earlier last year, we checked in on the “12 Stock Market Predictions for 2023” Sean Williams shared for The Motley Fool. At the time, we noted that it wasn’t looking good for those 12 prognostications.

Checking back in on those predictions as the year concludes, we see an accuracy rate of around 8%, only 1 out of the 12. Williams shouldn’t feel too bad though, as he has company in making terrible predictions.

Let us get one thing straight, like everyone else, we aren’t great at predictions. It’s why we don’t make them! Since we can’t reliably make and use predictions, we must do the complete opposite and rely on a rules-based, systematic, and repeatable process for managing your financial lives.

Here are a few rules that are essential to making wise investment decisions:

- Have a plan to know what you should buy and why.

- Have a plan to know how much you should buy

- Every time you buy an investment you need to proactively know what would cause you to sell.

- Every time you sell an investment, you need to proactively know what would cause you to buy it again or to buy something else.

These are some of the key decisions that determine long-term outcomes over time. Someone can make all the great predictions they want, but without a process for managing and responding to those questions, it doesn’t matter. A forecaster could be directionally right with their predictions but if the timing of the prediction is wrong, they may suffer a catastrophic outcome.

We are fond of saying that the average investor makes decisions that are often made emotionally and justifies them intellectually. Predictions are fertile ground for emotional decisions and intellectual justifications. The story of the prediction can hook your emotions and pull you down a dark road. On the other hand, using a repeatable process for making investment decisions flips the order to start from the intellectual standpoint. History tells us that starting from an intellectually honest and objective standpoint gives investors a better chance of attaining two things:

- Achieving the intended investment goal

- Managing emotions during periods of euphoria or fear in the market

We believe to be a successful risk manager we must rely on process over prediction. We are always ready for the “what ifs” while only acting on the “what is”. As you know from reading our Monthly Notes, at Spartan, we believe in and act on systems, with monthly reallocations to move toward stronger assets and away from weaker ones. Our goal is to remove guesswork and emotion from your financial life, especially when it comes to managing risk in your portfolio for the future.

As we roll into 2024, our focus remains the same: We are committed to guiding you toward a stress-free financial future! We are and will continue to help you make strides in reaching and maintaining your goals.

Sincerely,

The Spartan Team