Mistakes of Omission Are More Costly Than Bad Investments

“[People are] more likely to make mistakes of omission, not commission.”

–Warren Buffett

At Spartan Planning Group, we highly value simplification. We strive to make complex topics understandable and avoid unnecessary complexity by adhering to Albert Einstein’s principle of making things as simple as possible, but not simpler.

With the recent large movements in some stock market segments – prompting some declarations of another tech bubble – we are reminded of the biases of commission and omission and their relevance to trend following.

The biases of commission and omission correspond to statistical concepts known as type 1 and type 2 errors. Essentially these types of errors are as follows:

Type 1 error (false-positive): Taking an action that should have been avoided

Type 2 error (false-negative): Not taking an action that should have been executed

Trend following, which involves seeking to limit losses while letting winners run, naturally accepts small type 1 errors (commission) and aims to avoid type 2 errors (omission). Accepting that all investing involves some risk of loss is preferable to completely missing out on participating in a likely profitable investment over time. The issue with missing profitable investments, as some investors are currently experiencing, is twofold:

- Missing out on potential gains

- Being forced to take subsequent risks that would otherwise be unnecessary and likely avoided

In this month’s Note, we examine recent instances that highlight the cost of “sins of omission.” We also emphasize the importance of reviewing missed opportunities and the value of employing systematic investment strategies, like ours, to keep financial lives on track toward achieving future goals.

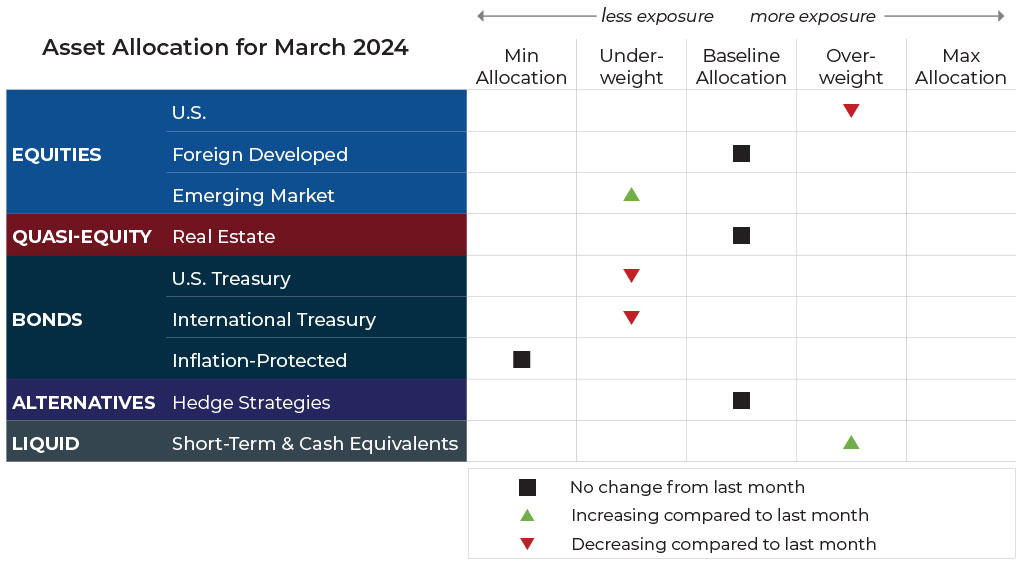

But first, here’s a summary of our response to what transpired in the markets heading into March.

Disclaimer: This note is for general update purposes related to the general strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your exposure to any given asset class will depend on your goals, risk profile, and how tactical or static your risk profile calls for. Adjustments can vary across strategies depending on each strategy’s objectives. What’s illustrated above most clearly reflects allocation adjustments for the Growth Strategy. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth, please contact your advisor.

ASSET-LEVEL OVERVIEW

Equities & Real Estate

As February drew to a close, the S&P 500 Index continued to enjoy an excellent start to the year, with the largest technology and communications companies fueling a rally and bringing equity asset classes into positive territory. After making a new all-time high for the first time since the opening trading day of 2022, the S&P 500 surpassed another milestone when it closed above 5,000 for the first time on February 9. As has seemingly become customary, other segments of the market, such as value and dividend stocks, continue to lag. However, returns still managed to be positive across the board. For March, Spartan Planning Group portfolios will generally see a slight decrease to U.S. equities, as it returns exposure to previously weaker international equities, which is described below.

Looking abroad, foreign equities again slightly underperformed their U.S. large-cap counterparts but finished positive for the month. In emerging economies, the lag relative to U.S. has been jarring at times, with economic weakness in China continuing to drag EM equity assets lower. Allocations to emerging market equities in Spartan Planning Group portfolios were at their minimum due to downtrends in overall meaningful timeframes in February. The modest bounceback in the asset class has caused a positive trend so exposure in our portfolios will increase, but it will remain underweight as the system continues to favor stronger U.S. equities.

Real estate steadied in February after retracing in January. With the relatively flat returns during the last month, it will remain in negative territory for the year. Despite the year-to-date performance, the overall picture for the asset class has not changed as the upward trends continue.

Fixed Income & Alternatives

With many segments in equities closing February at or near new all-time highs, fixed income generally continued to experience a retracement as market sentiment about the timing of rate decreases continued to shift out further. From a price perspective, the strongest areas of the yield curve continue to be with shorter duration. Allocations in our portfolios will undergo a corresponding shift, with longer-duration bonds being vacated in favor of higher-yielding, ultra-short-term bonds.

Sourcing for this section: ICE, S&P 500, 1/1/2021 to 1/29/2024; Barchart.com, Midcap ETF Vanguard (VO), 1/1/2024 to 1/26/2024; Barchart.com, Smallcap ETF Vanguard (VB), 1/1/2024 to 1/26/2024; Barchart.com, Real Estate Vanguard ETF (VNQ), 1/1/2023 to 1/29/2024; Barchart.com, 1-3 Year Treasury Bond Ishares ETF (SHY), 1/1/2024 to 1/26/2024; Barchart.com, 3-7 Year Treas Bond Ishares ETF (IEI), 1/1/2024 to 1/26/2024; and Barchart.com, 20+ Year Treas Bond Ishares ETF (TLT), 1/1/2024 to 1/26/2024

Three potential catalysts for trend changes:

- Flood Inflation: The last time Americans spent this level of money on food costs, George H.W. Bush was in office, the Super Nintendo was released, and the Dow Jones Industrial Average closed over 3000 for the first time. Eating continues to cost more and more, even though overall inflation has eased from 2022 and 2023. Restaurant and other eatery prices were up 5.1% compared to January 2023, and grocery costs followed suit with an increase of 1.2% during the same period.

- Economic Pause: The U.S. economic growth paused in January after brisk growth at the end of 2023. Retail sales fell 0.8% in January from December, worse than what was initially expected. Federal Reserve data showed January industrial production crawling down 0.1% compared with positive expectations. While technical factors may have exaggerated the weakness, a pullback by consumers could spell a weaker outlook for growth this year than in 2023, especially since consumers account for about two-thirds of economic activity.

- Future Cuts: As of last week, interest-rate futures suggested a greater than 50% chance the Federal Reserve would start cutting rates come the June meeting. The futures also indicated that investors believe the central bank will likely cut rates by a quarter-percentage point at least three more times by December. Joe Davis, Global Chief Economist at Vanguard, said recent data suggests current interest rates aren’t providing as much of a drag on the economy as Fed officials have thought.

Sourcing for this section: Wikipedia, “1991 in the United States,” 2/28/2024; The Wall Street Journal, “It’s Been 30 Years Since Food Ate Up This Much of Your Income,” 2/21/2024; The Wall Street Journal, “America’s Economy Slowed—It Probably Won’t Stumble,” 2/16/2024; The Wall Street Journal, “U.S. Shoppers Cut Back in January,” 2/15/2024; and The Wall Street Journal, “Data Show the Economy Is Booming. Wall Street Thinks Otherwise.,” 2/20/2024

Upside, Downside & Opportunity Cost

“The cost of being wrong is less than the cost of doing nothing.”

–Seth Godin

Discussions about trend following typically emphasize protecting against downside risk and capital preservation. However, with many equity markets near all-time highs, it’s important to highlight other facets of this strategy. For example, we believe trend following’s ability to capture the upside is crucial, even if this attribute generally receives significantly less attention.

Building on our previous month’s Note, we are taking a slightly different direction this month.

Systematic Investing Can Help Capture The Upside

Surprisingly, the art and science of trend following remain a mystery to many other financial professionals. However, it seems generally understood that tactical, systematic, trend-following processes may provide beneficial downside protection during extended financial market crises.

We have the privilege of discussing our process with many clients, and it generally resonates that vacating weaker markets in a rules-based way can reduce the negative side of market moves. What appears to be less understood, or underappreciated, is the ability of trend following to consistently participate in positive market moves in a way few investors have the courage to do. Take NVIDIA (ticker: NVDA) for example. We are beginning to lose count of the times we’ve heard some variation of the following statement. “Yeah, I bought it a while back and made a good return but got scared and sold it.”

As an illustration, let’s look at a basic and widely used trend-following strategy of buying an asset when its end-of-month price exceeds its 200-day exponential moving average. In the case of NVDA, this last occurred in January 2023.

Typically, trend-following strategies don’t reduce exposure (sell an asset) until certain pre-defined conditions are met. Using the illustration above one might reduce exposure when the price of the asset, at month end, is below the 200-day exponential moving average. For NVDA this was the case for most of 2022, but since January 2023 has been above that 200-day average price. Now, let’s bring the buy and sell rules together to summarize our point. Using those simple trend-following rules would result in an investor:

- Being out of NVDA for most of 2022, when the stock experienced roughly a 50% decline

- Purchasing NVDA early in 2023

- Continuing to hold NVDA until a downtrend emerges

Trend followers don’t exit when financial service pundits say it’s time to sell or because their gut tells them to do so. The exit timing comes only when the trend reverses. We and others believe this provides an opportunity to ride the coattails of well-performing positions (a positive trend) for as long as possible.

Why Do People Ignore Missed Opportunities?

While human nature often calls us to examine the cost of making a choice that, in hindsight, people shouldn’t have made (i.e., sins of commission), on the flip side, people rarely go back and diligently evaluate the cost of not doing something they should have done (i.e., sins of omission). The “sins of omission” are commonly known as opportunity cost. Reflecting on opportunity cost can yield powerful lessons that inform future choices.

This lack of circumspection creates a bias, where future opportunities may be missed due to not fairly evaluating the whole historical picture and how alternative decision-making processes could have helped. For example, how many investors have let their memories of an investment that lost money stop them from reinvesting, whether NVDA, the S&P 500, or otherwise, only to see that market make a sizable run without them?

Why do people ignore missed opportunities? It may be because what might have happened is opaque and fuzzy (i.e., requires work and self-knowledge). Maybe a fear of finding the truth and experiencing dissatisfaction with what we discover causes us to avoid doing the research as a defense mechanism.

In our opinion, one of the most unheralded benefits of trend following is that it eliminates this blind spot and resulting bias. When a systematic approach is embraced, we access a framework to address any market scenario that becomes a reality. Are the results always perfect? No, not any more than anything else in this world, but the drive for perfection is often the enemy of achieving what is optimal or sufficient.

It reminds us of a saying that economist Milton Friedman often used. In short, he said that those who focus on equality at the cost of liberty will get neither, but those who focus on liberty over equality will get a large measure of both. Regarding this month’s Note, we argue that those who favor perfect results over consistent returns will get neither, but those who favor consistency over perfection will get a large measure of both.

Many of you have heard us repeat our investment mantra of “we want to be consistently good rather than just occasionally great”. Hopefully this resonates with you and is given more meaning after reading this note. Many of you have lived this out in your financial lives by building your savings over decades rather than banking on a winning lottery ticket. Our desire is to apply that same prudence to the way we keep you on the path to fulfilling your goals.

Sincerely,

The Spartan Team