A Disciplined Strategy Helps Avoid Self-Inflicted Wounds

“The investor’s chief problem — and even his worst enemy — is likely to be himself.” – Benjamin Graham

Great investors don’t just accumulate experience — they learn from it. The best share a common trait: they don’t chase what’s flashy or react impulsively. They rely on time-tested processes that remove emotion from decision-making.

After years of observing what works and what doesn’t, we have seen investors make the same mistakes over and over: chasing past winners, selling in fear, and letting short-term emotions derail long-term success.

Every year, the data confirms what professional advisors have long known: investor behavior is often the biggest drag on returns. An annual study by DALBAR quantifies this gap, showing just how much poor decision-making costs the average investor. The takeaway is clear — having a disciplined strategy isn’t just about maximizing returns; it’s about avoiding the self-inflicted wounds that erode them.

In this month’s Note, we explore why closing the behavior gap is one of the most valuable roles an advisor can play. We also highlight why systematic trend following isn’t just an investment strategy; it’s a behavioral advantage that helps investors stay the course through all market conditions.

But first, here’s a summary of our take on what transpired in the markets in February.

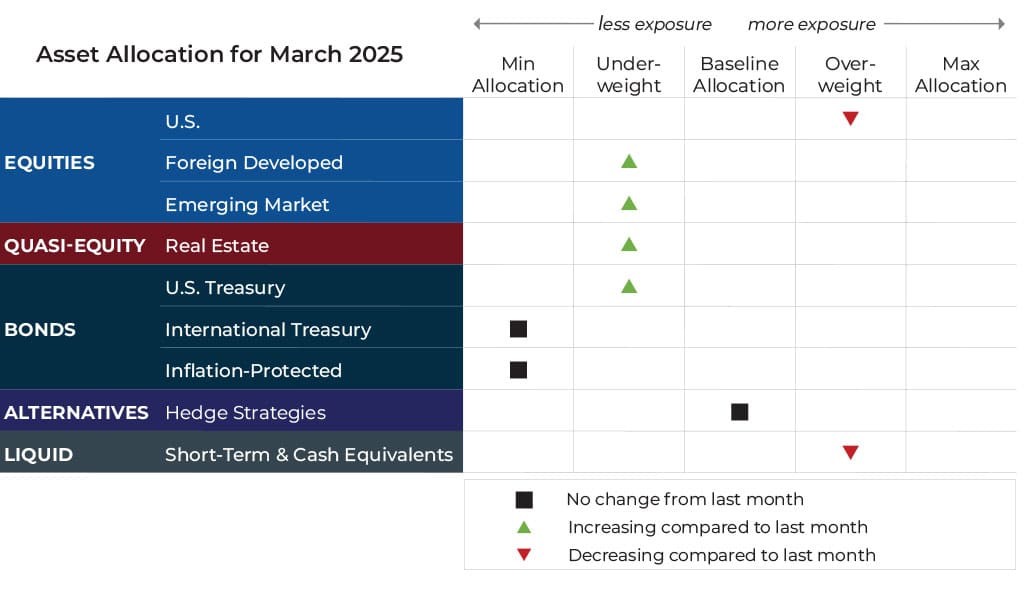

Disclaimer: This note is for general update purposes related to the general strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your exposure to any given asset class will depend on your goals, risk profile, and how tactical or static your risk profile calls for. Adjustments can vary across strategies depending on each strategy’s objectives. What’s illustrated above most clearly reflects allocation adjustments for the Growth Strategy. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth, please contact your advisor.

Asset-Level Overview

Equities & Real Estate

After making new all-time highs on February 19, the S&P 500 Index has pulled back a bit as it struggles to finish with a positive monthly return. Dividend payers have led, putting them in a top spot year-to-date as well. Small caps are the worst performing U.S. segment in February and one of the poorer performers for the year so far, with growth stocks also performing near the bottom domestically. Despite the mixed performance, all segments are looking at uptrends across all timeframes, except for small caps, which are flirting with an intermediate-term downtrend.

Just when investors had begun to give up on international equities, they began the year by leading over their U.S. counterparts. Both foreign developed and emerging markets are on track for solid returns in February, extending their lead for the year. While still trailing the U.S. in our measures of relative strength, they are now experiencing uptrends across all timeframes.

Real estate securities have quietly regained their footing after a poor close to 2024, managing to regain uptrends across all timeframes but continuing weakness relative to other equity or equity-like segments. The result is that our allocations will increase slightly but remain underweight.

Fixed Income & Alternatives

While the odds of rate cuts continue to dwindle, fixed income prices have stabilized and even made some progress toward regaining uptrends. In fact, 1- to 3-year Treasuries have generated an intermediate-term uptrend and will receive an allocation accordingly, but that is the only timeframe and segment in a rising-trend state.

In the alternative allocation of our portfolios, the largest exposure remains tilted toward the fixed income sector. Like the non-alternative fixed income allocation, the portfolio favors long positions in short-duration government bonds. The equity sector is predominantly hedged but retains a net long position, with most of its long exposure focused in the U.S. Additionally, commodities exposure continues to hold a net long position. Currencies, particularly those pegged against the U.S. Dollar, are now a meaningful short position in the portfolio.

Sourcing for this section: Reuters, “S&P 500 edges to record closing high as Fed minutes parsed,” 2/19/2025

Three potential catalysts for Trend Changes:

-

Consumer Spending Driven by Top 10% of Earners: The top 10% of earners, which are households making around $250,000 a year or more, are spending: vacations, handbags, and other luxury items. The spending is supported by big gains in stocks, real estate, and other assets. Those households now account for 49.7% of all spending, a record in data going back to 1989; 30 years ago, they accounted for about 36%. Mark Zandi, Chief Economist at Moody’s Analytics, has estimated that spending by the top 10% accounts for almost one-third of gross domestic product.

-

Housing Woes: Sales of new homes dropped in January. Elevated prices and persistently high mortgage rates continued to weigh on potential buyers. Sales of new single-family homes declined to 657,000, which is down 10.5% from the prior month; compared with January 2024, sales were down 1.1%. As for existing home sales, they fell 4.9% in January.

-

Hiring Pessimism: Optimism about the U.S. economy and job market has not translated into tangible increases in hiring activity. Executives at Randstad, the largest employment agency by revenue, say they see a disconnect between sentiment and reality in the U.S., as businesses profess a strong job market but recruiters wait for a hiring surge. “Our clients have been dealing with inflation, high interest rates… so hiring activity has been very low; however, we see early cyclical sectors starting to improve,” Randstad CFO Jorge Vazquez said.

Sourcing for this section: The Wall Street Journal, “The U.S. Economy Depends More Than Ever on Rich People,” 2/23/2025; The Wall Street Journal, “U.S. New-Home Sales Slump at Start of 2025,” 2/26/2025; and The Wall Street Journal, “U.S. Economic Optimism Isn’t Converting Into Hiring Yet, Randstad CEO Says,” 2/12/2025

A Refresher on DALBAR’s Research

“You can observe a lot by just watching.” – Yogi Berra

If you’ve met with us, in-office or virtually, you have probably had an encounter with Ira, our favorite octogenarian advisor. He has seen it all during his many years of working in both the private and public sectors, and he became a champion of trend following relatively later in life.

Besides being one of the kindest, most generous, and humble servant leaders we have ever encountered, his experience and subsequent conviction in trend following inspires tremendous confidence. Here’s a guy who has observed what works and what doesn’t. Through managing money over many booms and busts, he is unafraid to call a spade a spade, and he does not put up with foolish strategies.

We were recently discussing a timeless gem: the renowned annual DALBAR Quantitative Analysis of Investor Behavior (QAIB) report. Over the years, we have repeatedly referred to this important research as a justification for the benefits of having a professional financial advisor paired with systematic trend following.

As a refresher, DALBAR’s study assigns a numeric value to the shortfall between typical investor returns and the relevant indexes. It then explains why this shortfall is largely attributable to poor investor decision-making. The general idea is that if you did nothing and invested in the index, you would get the index return minus fees. Thus, and all else equal, any return above or below the index is explained by actions taken by the investor.

A summary of the most recent analysis can be found here. For ease, we’ve excerpted key findings below:

- The Average Equity Fund Investor Underperformed the Market: The Average Equity Investor earned 5.5% less than the S&P 500 in 2023, the 3rd largest investor gap in the last 10 years.

- The Average Fixed Income Investor Underperformed to a Lesser Degree: The Average Fixed Income Investor earned 2.63% less than the Bloomberg Barclays Aggregate Bond Index gain.

- Emotional Decisions Hurt Returns: Investors tend to sell out of investments during downturns and miss out on rebounds. The report illustrates the importance of a long-term investment strategy.

- Retention Rates Increased: The Average Equity Fund Investor held onto equity funds for a longer period in 2023 compared to 2022.

We believe these findings are important for our clients to understand. They demonstrate that the goal should not necessarily be to beat the market, as well that financial advisors can help investors close the gap on the market since studies show they would woefully underperform if left to their own devices. Beating a reasonable benchmark is fantastic, but that is not realistic for most clients without the aid of an advisor. This knowledge should help change the framework and set expectations.

Another big takeaway from the DALBAR study is that using strategies that can improve investor behavior is arguably the easiest way for clients to benefit from an investment management perspective. In our opinion, nothing holds a candle to systematic trend following when it comes to improving behavior and helping clients stay on track.

Sometimes, in the push for more and more returns, it is easy to slightly lose sight of the gap we are trying to close between the goal and reality.

Disclaimer: this note is for general update purposes related to the strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your particular exposure to any given asset class will depend on your goals, risk profile, and how tactical or passive your risk profile calls for. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth please contact your advisor. This email and the data herein is not a solicitation to invest in any investment product nor is it intended to provide investment advice. It is intended for information purposes only and should be used by investment professionals and investors who are knowledgeable of the risks involved. No representation is made that any investment will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses. While every effort has been made to provide data from sources considered to be reliable, no guarantee of accuracy is given. Historical data are presented for informational purposes only. Investment programs described herein contain significant risks. A secondary market may not exist or develop for some investments portrayed. Past performance is not indicative of future performance. Investment decisions should be made based on the investors specific financial needs and objectives, goals, time horizon, tax liability, risk tolerance and other relevant factors. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Investors should consider the underlying funds’ investment objectives, risks, charges and expenses carefully before investing. The Advisor’s ADV, which contains this and other important information, should be read carefully before investing. ETFs trade like stocks and may trade for less than their net asset value. Spartan Planning Group, LLC (“Spartan” or the “Advisor”) is registered as an investment adviser with the United States Securities and Exchange Commission (SEC). Registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the Adviser has attained a particular level of skill or ability. Indexes are unmanaged and do not incur management fees, costs, and expenses. Spartan’s risk-management process includes an effort to monitor and manage risk, but should not be confused with and does not imply low risk or the ability to control risk. There are risks associated with any investment approach, and Spartan strategies have their own set of risks to be aware of. First, there are the risks associated with the long-term strategic holdings for each of the strategies. The more aggressive the Spartan strategy selected, the more likely the strategy will contain larger weights in riskier asset classes, such as equities. Second, there are distinct risks associated with Spartan Strategies’ shorter-term tactical allocations, which can result in more concentration towards a certain asset class or classes. This introduces the risk that Spartan could be on the wrong side of a tactical overweight, thus resulting in a drag on overall performance or loss of principal. International investments may involve additional risks, which could include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks. Diversification strategies do not ensure a profit and do not protect against losses in declining markets.