Simplicity Is a Good Defense Against Uncertainty

“The art of life lies in a constant readjustment to our surroundings.” – Kakuzō Okakura

In investing, uncertainty isn’t a bug — it’s a feature.

No matter how much data we gather or how many historical patterns we study, markets have a way of surprising even the most seasoned observers. The challenge isn’t in predicting these surprises; it’s in expecting and preparing for them.

At Spartan Planning Group, we believe the best defense against uncertainty isn’t complexity, but simplicity. Rather than layering on endless rules to account for every possible market twist, we focus on the few relationships that have demonstrated durability over time. One of the most reliable patterns we observe is the clustering of volatility — the idea that extreme moves, both up and down, often come in waves.

April provided a vivid reminder of this phenomenon, as sharp declines and dramatic rallies unfolded within days of each other. Moments like these reinforce why our systematic investing approach emphasizes trend direction, not short-term prediction. It’s not about avoiding every bump; it’s about consistently adapting to the environment, reducing risk when conditions warrant, and positioning for long-term compounding.

In this month’s Investment Update, we explore how April’s market behavior illustrated the power — and necessity — of simplicity, discipline, and flexibility in portfolio management.

But first, here’s a summary of our take on what transpired in the markets in April.

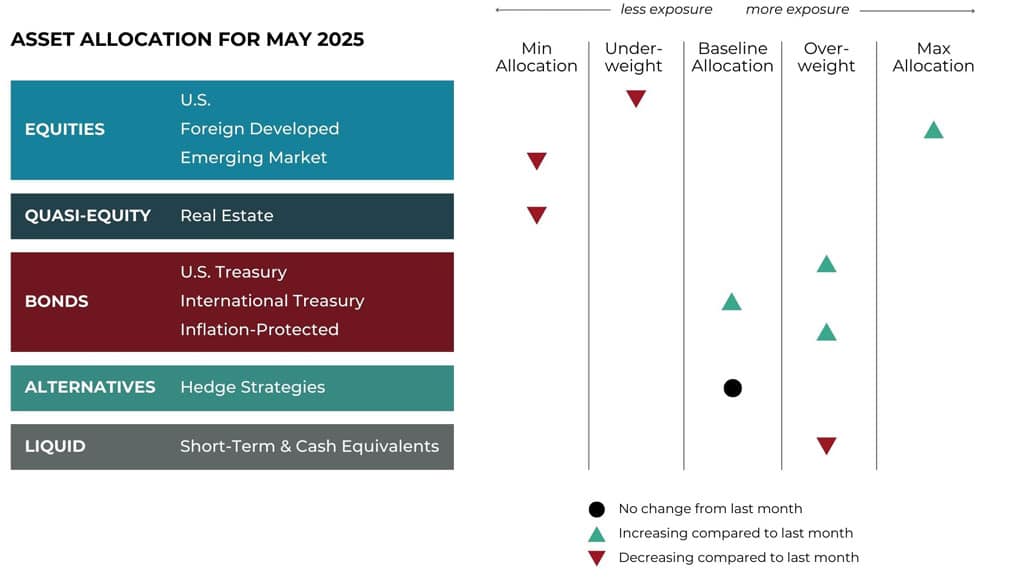

Disclaimer: This note is for general update purposes related to the general strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your exposure to any given asset class will depend on your goals, risk profile, and how tactical or static your risk profile calls for. Adjustments can vary across strategies depending on each strategy’s objectives. What’s illustrated above most clearly reflects allocation adjustments for the Growth Strategy. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth, please contact your advisor.

Asset-Level Overview

Equities & Real Estate

Not since COVID-19 have equity markets in the U.S. declined as quickly as they did during early April. Uncertainty about the severity and impact of tariffs drove stocks downward, briefly touching off the mainstream definition of a bear market (i.e., a 20% decline from the previous peak). In the second half of the month, prices have stabilized but are still on pace to finish negative and push the asset class into full downtrends, according to our definitions. The result for our portfolios will be a decrease in exposure to near minimum levels.

International stocks are mixed, with developed countries continuing to be the equity bright spot. Trends remain positive after briefly dipping into negative territory at the start of the month. Emerging market equities, which were weaker than their developed counterparts at the start of the month, failed to recover quickly enough to maintain their uptrends. The result for our portfolios is that exposure from weaker emerging markets will be vacated and handed to stronger developed market equities.

Real estate securities also fell in April and are now in downtrends across both timeframes. This asset class has not been strong in 2025, so it is no surprise that the uptrends could not be sustained. The remaining tactical exposure will be vacated and handed off to a combination of hedged U.S. equities and fixed income for May.

Fixed Income & Alternatives

Fixed income remains a mixed bag. The middle of the yield curve, both domestically and internationally, is producing early uptrends, but longer duration remains in negative price trends across all timeframes. Inflation-protected bonds also continue to do well and will move to overweight in our portfolios.

Overall, the exposures to intermediate-term bonds in our strategies are the highest it has been in years. In recent occurrences, it has failed to sustain these trends. We will wait and see whether it can this time.

Within the alternatives allocation, long fixed income has steadily been near or at the top of the exposure rankings. With the strengthening of intermediate length bonds less than 10 years, this will expand further as April closes. Longer duration bonds remain weak and thus will predominantly be held in short positions, as they have recently. Commodities, led by gold, will remain net long, and U.S. Dollar weakness will drive up allocations to international currencies. Stocks, which just a few months ago were the largest net exposure (long), will now be almost perfectly hedged with longs matching shorts.

3 Potential Catalysts for Trend Changes

GDP Pullback: The U.S. economy slowed in the first quarter of 2025, as increased imports ahead of tariffs and slower consumer spending resulted in a reduced GDP. The Commerce Department said U.S. GDP fell at a seasonally- and inflation-adjusted 0.3% annual rate during January to March. That was the steepest decline since the first quarter of 2022. Imports increased at a 41.3% pace while exports experienced a 1.8% increase during the first quarter. Final sales to private domestic purchasers, which is a measure of consumer and business spending that gauges underlying demand in the economy, rose at a 3% annual rate.

Consumer Sentiment: American households ended April feeling worse about the economy than in March, according to the closely watched University of Michigan poll. The final reading for April was 52.2, down from 57 in March. The index registered its lowest levels ever for Democrats and independents. Consumer sentiment among Democrats was 34.4, the lowest reading on record, while sentiment among Republicans rose to 90.2, the highest since the end of President Donald Trump’s previous term. Republicans, Democrats, and independents all said they expect higher inflation.

Spending Pullback: There are early warning signs for consumer spending. Consumers are delaying nonessential splurges. For example, according to executives at American Express and Citigroup, travel and entertainment spending declined during the first quarter while spending on less-discretionary categories increased. Additionally, the share of cardholders making only the minimum payment is running above pre-pandemic levels, according to Capital One. Overall consumer spending rose at a 1.8% annual rate during Q1, dropping sharply from 4% in the final quarter of 2024.

Sourcing for this section: The Wall Street Journal, “U.S. Economy Contracts at 0.3% Rate in First Quarter,” 4/30/2025; The Wall Street Journal, “American Consumers Serve Up Bleak Outlook on Economy,” 4/25/2025; and The Wall Street Journal, “Credit-Card Companies Brace for a Downturn,” 4/22/2025

Perfect Robustness Is Unattainable

“Given the unattainability of perfect robustness, we need a mechanism by which the system regenerates itself continuously by using, rather than suffering from, random events, unpredictable shocks, stressors, and volatility.” – Nassim Taleb

In financial markets, there are no guarantees. With enough time, something that has never happened before WILL happen. Relationships, behaviors, and ultimately outcomes that seem impossible will come to fruition at some point. It’s one of the reasons we find predictions so counterproductive.

When it comes to portfolio management, our opinion is that the best process is one rooted in persistent, observable behaviors that:

- Are intuitive and reliable over very long periods of time

- Will not sink an investor when (not if) they are temporarily broken

To account for the tendency of markets to dislocate from historical norms, it is tempting to compile a collection of rules to counteract every permutation of market behavior, but this is a fallacy in our view. Our practice is to instead use as few rules as possible, with those rules rooted in only the most stable historical relationships. We believe this boosts the ability of our investment systems to withstand, or even take advantage of, outlier behavior.

One of the most stable behaviors we have observed in financial markets is the tendency of price volatility to cluster during certain environments. These environments can be defined in a myriad of ways, but we categorize them based on their position relative to (i.e., above or below) average prices over given time periods. Specifically, our investing process considers price during the last 10, 50, 100, and 200 days.

We are always prepared for markets to buck these behaviors, but April proved to be yet another data point in favor of our research findings. Last month, we discussed how the market had reached a point where action was necessary to be ready for the possibility of further declines. If you think of market price behavior and our ensuing action as a stoplight, we were entering a yellow-light scenario where it was appropriate to cut allocations and reduce risk based on our definition of downtrends. Right on cue, equity markets accelerated downward, the S&P 500 Index briefly touched the mainstream bear market definition of a 20% decline from its peak, and certain previous market leaders fell 40% or more.

Simultaneously, another interesting element of equity markets that we like to repeatedly highlight also came to pass. We love to poke fun at the so-called best 10 days rule, which states that investors who miss out on these best days severely underperform the market. But, when you review the data, you find that these 10 BEST days tend to occur during downtrending markets that cluster together with the 10 WORST days. Our research shows that it is actually better to miss BOTH the 10 best AND 10 worst days via trend following.

To demonstrate our point, consider:

- April 9 was the third-best day ever (+9.5%) for the S&P 500 Index).

- Yet, just three trading days prior, the market suffered its fifth-worst two-day decline in about 80 years (-4.9% April 3 and -6.0% April 4).

It doesn’t take a rocket scientist to do the quick math and see that the April 9 increase was less than the combined decreases of April 3-4. Mathematically, and all else equal, an investor was better off missing all three days than being invested for them. This is why we prefer to refer to the “best 10 days rule” as the “best 10 days MYTH”.

As we enter May, we will maintain material equity exposure, especially to international developed countries. However, our U.S. equity exposure will be near its lowest levels since 2022. We have entered a red-light scenario for U.S. stocks as a whole. As always, what happens from here is unknown. While there are no guarantees in markets, there are assurances that can be created from action. In other words, while we have no idea what the markets are about to do, we are 100% confident that if we reduce our risk, we will be less exposed to a continued decline.

Certainly, a rally is possible, especially if the tariff picture becomes less cloudy, but the beauty of riding strong trends in 2023 and 2024 is that we can afford to be more cautious amid the headwinds of 2025. We will continue to execute our strategies in a disciplined manner to put our clients in the best positions to maximize compounding to reach their goals.

Sourcing for this section: The Motley Fool, “The Stock Market Just Had One of Its Best Days Ever: Here’s What History Says Comes Next.,” 4/14/2025; The Motley Fool, “The S&P 500 Just Did Something Seen

Disclaimer: this note is for general update purposes related to the strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your particular exposure to any given asset class will depend on your goals, risk profile, and how tactical or passive your risk profile calls for. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth please contact your advisor. This email and the data herein is not a solicitation to invest in any investment product nor is it intended to provide investment advice. It is intended for information purposes only and should be used by investment professionals and investors who are knowledgeable of the risks involved. No representation is made that any investment will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses. While every effort has been made to provide data from sources considered to be reliable, no guarantee of accuracy is given. Historical data are presented for informational purposes only. Investment programs described herein contain significant risks. A secondary market may not exist or develop for some investments portrayed. Past performance is not indicative of future performance. Investment decisions should be made based on the investors specific financial needs and objectives, goals, time horizon, tax liability, risk tolerance and other relevant factors. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Investors should consider the underlying funds’ investment objectives, risks, charges and expenses carefully before investing. The Advisor’s ADV, which contains this and other important information, should be read carefully before investing. ETFs trade like stocks and may trade for less than their net asset value. Spartan Planning Group, LLC (“Spartan” or the “Advisor”) is registered as an investment adviser with the United States Securities and Exchange Commission (SEC). Registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the Adviser has attained a particular level of skill or ability. Indexes are unmanaged and do not incur management fees, costs, and expenses. Spartan’s risk-management process includes an effort to monitor and manage risk, but should not be confused with and does not imply low risk or the ability to control risk. There are risks associated with any investment approach, and Spartan strategies have their own set of risks to be aware of. First, there are the risks associated with the long-term strategic holdings for each of the strategies. The more aggressive the Spartan strategy selected, the more likely the strategy will contain larger weights in riskier asset classes, such as equities. Second, there are distinct risks associated with Spartan Strategies’ shorter-term tactical allocations, which can result in more concentration towards a certain asset class or classes. This introduces the risk that Spartan could be on the wrong side of a tactical overweight, thus resulting in a drag on overall performance or loss of principal. International investments may involve additional risks, which could include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks. Diversification strategies do not ensure a profit and do not protect against losses in declining markets.