Why We Don’t Try to Read Political or Economic Tea Leaves

“The art of simplicity is a puzzle of complexity.” – Douglas Horton

During the election season, markets can reflect a broader, collective sentiment — sometimes swayed by predictions, fears, and assumptions about the future. In times like these, emotional investing is seemingly at an all-time high, with many investors feeling the pull to respond to headlines and perceived market shifts. But while the news cycle may push for reaction, our approach remains consistent: disciplined, systematic trend following.

In investing, staying the course requires a willingness to let markets tell us where the real opportunities are, even when external forces attempt to predict or sway. At Spartan Planning Group, we aim to mute the noise by anchoring our decisions to repeatable and reliable systems rather than attempting to read the political or economic tea leaves. It’s a steady-handed strategy, and while it may not grab headlines, we believe it’s one of the best ways to deliver long-term, repeatable results.

Does this mean we’ll always be well-positioned for whatever happens during every upcoming event? That’s unknowable until after the fact. However, we take confidence in the principle that price often predicts news. In other words, should a downside surprise in markets occur as a result of any event, systematic investing strategies that use a trend-following approach will provide predetermined exits aimed at limiting downside risk to buffer their long-term effects on your financial lives.

Alongside the recent election, the unprecedented rise in NVIDIA’s market cap has been the talk of the town. Therefore, in this Monthly Note, we discuss:

The potential risks of market concentration.

Why a disciplined trend-following approach has kept us positioned in NVIDIA through market shifts.

How staying committed to trends, even during periods of uncertainty, supports both growth and risk management.

Why a consistent systematic approach can provide investors with a reliable framework regardless of market or political cycles.

But first, here’s a summary of our take on what transpired in the markets as we transitioned to November.

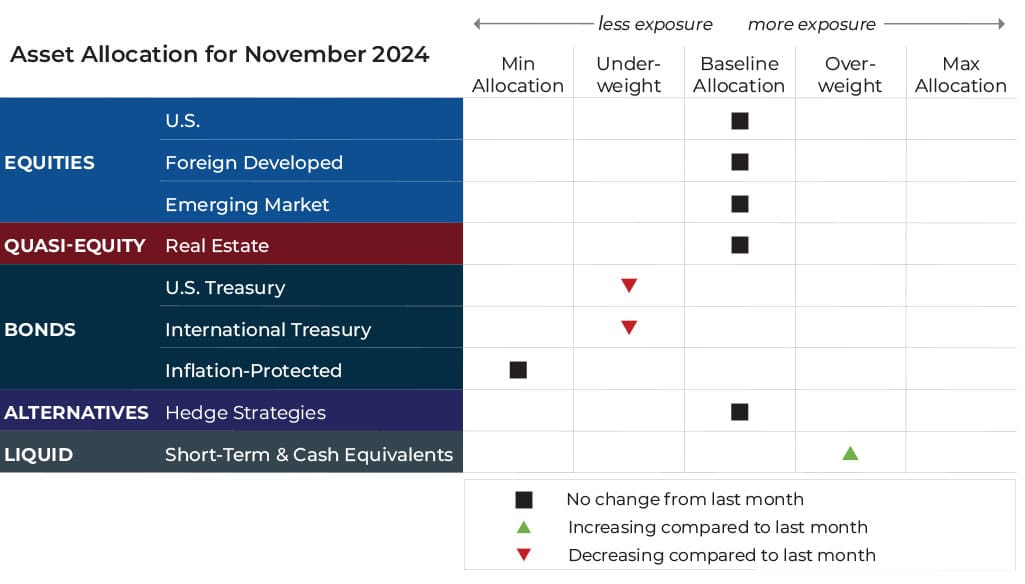

Disclaimer: This note is for general update purposes related to the general strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your exposure to any given asset class will depend on your goals, risk profile, and how tactical or static your risk profile calls for. Adjustments can vary across strategies depending on each strategy’s objectives. What’s illustrated above most clearly reflects allocation adjustments for the Growth Strategy. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth, please contact your advisor.

ASSET-LEVEL OVERVIEW

Equities & Real Estate

Another month, another new all-time high in the S&P 500 Index. Despite one of the most contentious elections in recent memory and continued escalation in the Middle East between Israel and its neighbors, the benchmark U.S. index remains on its march higher as we drift further into the fourth quarter. For the year, U.S. large-cap growth stocks are still in front, but almost all segments are having a relatively good 2024. Volatility also remains low, which is almost always associated with continued strength in equities. As a result, there were no changes to the U.S. equity allocation for this month.

Emerging markets pulled ahead of their developed counterparts for the year but remain weaker than U.S. stocks. Like in the U.S., trends continue to be positive and consequently, there was no change to exposure in November.

Doubts about whether the Federal Reserve will be able to continue cutting rates as aggressively as it did in September put a damper on the recent rally among real estate securities during October. Despite that, trends continue to be positive. There was no change to the real estate allocations in our portfolios.

Fixed Income

After a run of four straight months of exposure increases to higher-duration bonds in our portfolios, October provided a sharp retracement to bond prices as yields rose. While not all the accumulated allocation will be vacated, a sizable portion of it will return to ultra-short-term bonds, which have often held much of the bond exposure since late 2021 when rates first began increasing. These types of whipsaws in markets are a reality of trend following. That said, over the long-term, they tend to not materially impact performance and can provide valuable opportunities to harvest losses against other better-performing assets, such as U.S. equities in 2024.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 1/1/2024 to 10/29/2024

Three potential catalysts for trend changes:

-

Goldilocks Economy: Gross domestic product increased at a 2.8% annual rate in Q3, adjusted for seasonality and inflation. Consumer spending represents a large amount of economic activity in the U.S. and picked up to a 3.7% growth pace during the same period. Other tailwinds were strong exports and government spending on defense. Inflation showed cooling: the personal consumption expenditures (PCE) price index eased to a 1.5% annualized rate versus 2.5% in Q2 while the core PCE index cooled to 2.2% from 2.8% (hovering near the Federal Reserve’s target of 2% annual inflation). However, the two big, recent hurricanes are likely to show up in data for Q4 and beyond.

-

Mortgage Rates Drop, Then Bounce Back: Expectations that the Federal Reserve would cut rates caused mortgage rates to drop to 6.08%, which is a two-year low. But the move may have come too late in the year to lure buyers, as many families prefer to buy in the spring and move houses between school years. The reprieve did not last long, with rates recently rising for three straight weeks to the highest level since August to 6.54%. As a result, mortgage applications have fallen for four straight weeks.

-

Home Sales: For the second consecutive year, existing home sales are on track for the worst year since 1995. New-home sales rose 6% in September versus one year ago, driven largely by the fact that there has been little else available to buy. About 60% of outstanding U.S. mortgage holders have a rate below 4%, there is pent-up demand to sell homes, and the aggregate value of home equity as a share of total real-estate value has hit 73% – the highest level since the 1950s. This may make homeowners willing to take on more expensive mortgages sooner than expected.

The Wall Street Journal, “U.S. Economic Growth Extends Solid Streak,” 10/20/2024; The Wall Street Journal, “Home Sales on Track for Worst Year Since 1995,” 10/23/2024; Federal Reserve Economic Data, 30-Year Fixed Rate Mortgage Average in the United States, 10/24/2024; and The Wall Street Journal, “Home Builders Usually Love Cheap Mortgages—Maybe Not This Time,” 10/30/2024

The Rise & Risk Of NVIDIA

“The best thing one can do when it’s raining is to let it rain.” – Henry Wadsworth Longfellow

Torsten Sløk, an economist at Apollo Group Management, recently highlighted what we think are some mind-blowing facts about NVIDIA. He noted:

NVIDIA’s market capitalization is now bigger than FIVE of the G7 countries.

Only the U.S. and Japan have a higher overall market cap than the AI darling.

This means NVIDIA surpasses the value of entire equity markets for Canada, the U.K., France, Germany, and Italy. In fact, you could combine Germany and Italy and it would still be smaller than NVIDIA.

About one year ago, NVIDIA was flirting with a ceiling of around $500 per share (i.e., equivalent to $50 per share in today’s post-10:1 split world). It has now hit new all-time highs that are almost 3x that level (i.e., $140 per share or $1,400 on a pre-split basis)! The impressive increase in value has no doubt boosted many investors’ returns but also now represents a meaningful risk in many investors’ minds.

The rise and risk of NVIDIA can be used to illustrate what we believe are two of the most unheralded benefits of systematic trend following:

1) Staying the course (in a repeatable way) when your brain is screaming, “Run!” At $500 per share ($50/share post-split) our portfolios were overweight to NVIDIA. At that time we can recall hearing concerns about the risk of a steep decline in the stock, which could negatively impact a portfolio. We will not take any personal credit for staying the course, as the decision had everything to do with our repeatable trend-following rules and nothing to do with our powers of prediction. Fast forward a year, and that systematic overweight stance has arguably provided the largest attribution to positive performance during the last year and beyond.

2) Providing a kill switch to exit a trend. Not only does trend following provide what we believe is the most reliable way to capture outliers, but in our opinion, it also allows us to have a RELIABLE exit strategy when the tide eventually turns. One of the tools we use for this purpose is the 100-day exponential moving average (EMA). At the end of 2023, NVIDIA closed the year a little above $49 per share and its 100-day EMA was around $45 — that was about $4 away from the sell-point if someone were to use the 100-day EMA as their sole rule for when to sell. While our exact exit would not have necessarily been that price, we certainly would have been standing by, ready to reduce exposure if all the data we monitor called for it. Another important aspect of our trend-following process is: As a stock’s price increases, so does its 100-day EMA. Therefore, NVIDIA’s EMA has now increased to around 110 per share. This means that our approximate reduction point has automatically increased in a way that reliably adjusts for volatility, gives the stock room to continue running, and doesn’t require giving up a large portion of gains from the last year.

The key concept from the last two paragraphs is reliability. It is one thing to capture returns. It is quite another to do it in a way that the same set of facts can produce a consistent outcome over and over. That is our goal at Spartan, being consistently good rather than occasionally great.

Although solid returns are great, we find that alone is not enough. For clients to be able to lean on us and rely on our stewardship, we have to manage risk in a way that is repeatable now, next year, 10 years from now, and beyond.

A day of reckoning is possible for NVIDIA, but who knows when that will be and what it will look like? One thing we believe though, is individual investors with overly-concentrated portfolios and no plan will likely pay the price. In our opinion, it is better not to guess, but rather to have a process that is agnostic and indifferent. We have no emotional connection to NVIDIA but are happy to benefit from its rise for as long as the trend permits. We continue to be thrilled to extend this measured, resilient approach to provide repeatable, consistent risk management and hopefully confidence and clarity for your financial future.

Sourcing for this section: Barchart.com, Nvidia Corp (NVDA), 10/30/2023 to 10/30/2024 and Apollo Academic, “It Is All About NVIDIA,” 10/24/2024

Sincerely,

The Spartan Team

Disclaimer: this note is for general update purposes related to the strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your particular exposure to any given asset class will depend on your goals, risk profile, and how tactical or passive your risk profile calls for. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth please contact your advisor. This email and the data herein is not a solicitation to invest in any investment product nor is it intended to provide investment advice. It is intended for information purposes only and should be used by investment professionals and investors who are knowledgeable of the risks involved. No representation is made that any investment will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses. While every effort has been made to provide data from sources considered to be reliable, no guarantee of accuracy is given. Historical data are presented for informational purposes only. Investment programs described herein contain significant risks. A secondary market may not exist or develop for some investments portrayed. Past performance is not indicative of future performance. Investment decisions should be made based on the investors specific financial needs and objectives, goals, time horizon, tax liability, risk tolerance and other relevant factors. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Investors should consider the underlying funds’ investment objectives, risks, charges and expenses carefully before investing. The Advisor’s ADV, which contains this and other important information, should be read carefully before investing. ETFs trade like stocks and may trade for less than their net asset value. Spartan Planning Group, LLC (“Spartan” or the “Advisor”) is registered as an investment adviser with the United States Securities and Exchange Commission (SEC). Registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the Adviser has attained a particular level of skill or ability. Indexes are unmanaged and do not incur management fees, costs, and expenses. Spartan’s risk-management process includes an effort to monitor and manage risk, but should not be confused with and does not imply low risk or the ability to control risk. There are risks associated with any investment approach, and Spartan strategies have their own set of risks to be aware of. First, there are the risks associated with the long-term strategic holdings for each of the strategies. The more aggressive the Spartan strategy selected, the more likely the strategy will contain larger weights in riskier asset classes, such as equities. Second, there are distinct risks associated with Spartan Strategies’ shorter-term tactical allocations, which can result in more concentration towards a certain asset class or classes. This introduces the risk that Spartan could be on the wrong side of a tactical overweight, thus resulting in a drag on overall performance or loss of principal. International investments may involve additional risks, which could include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks. Diversification strategies do not ensure a profit and do not protect against losses in declining markets.