Why We’re Willing — And Wanting — To Look Different From the Norm

“You cannot swim for new horizons until you have courage to lose sight of the shore.” – William Faulkner

In investing, the principle of non-correlation presents both opportunities and challenges.

While our portfolios may not look drastically different from traditional approaches today, there have been and will likely be other times when they do. Non-correlation involves holding investments that don’t always move in sync with the broader market. While this can sometimes feel uncomfortable, we believe it is a crucial tool for prudently managing risk, reducing volatility, and enhancing long-term growth potential.

This concept and willingness to look different is key. It’s like carrying an umbrella on a cloudy day when no one else does — it may seem unnecessary at the time, but when the market storms inevitably come, you’re better prepared. Holding non-correlated assets can feel counterintuitive when traditional investments are performing well, but these same assets often provide the stability needed when market conditions shift. While looking different may be tough in the moment, it’s often the foundation for achieving a more resilient, long-term outcome.

In this month’s Note, we discuss:

- The advantages we see in trend following during unpredictable markets

- How trend following steers us away from the pitfalls of market predictions

- Why a disciplined, systematic approach may reduce risk while helping keep the focus on long-term growth

But first, here’s a summary of our take on what transpired in the markets heading into October.

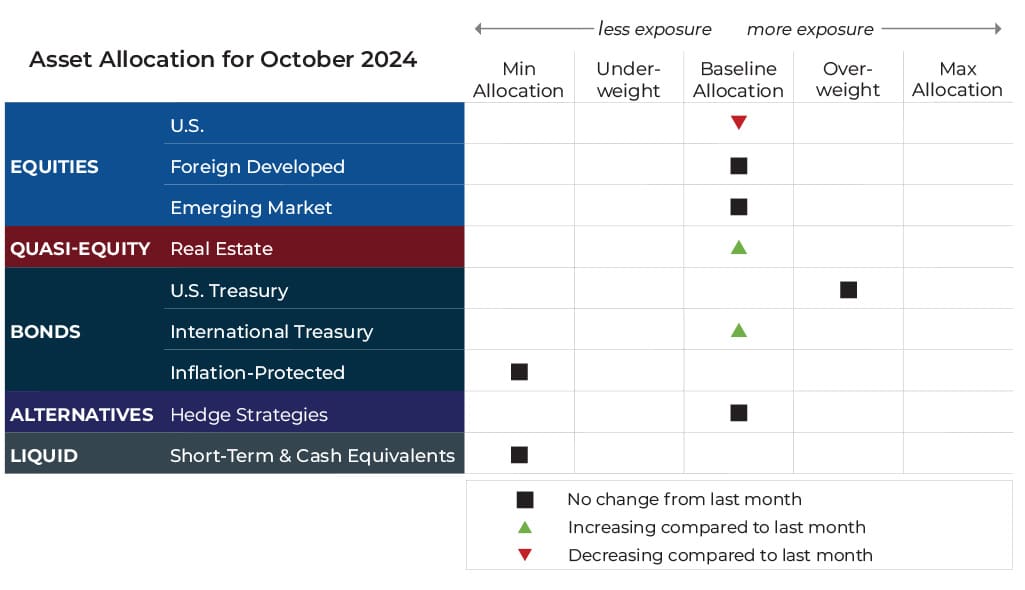

Disclaimer: This note is for general update purposes related to the general strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your exposure to any given asset class will depend on your goals, risk profile, and how tactical or static your risk profile calls for. Adjustments can vary across strategies depending on each strategy’s objectives. What’s illustrated above most clearly reflects allocation adjustments for the Growth Strategy. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth, please contact your advisor.

ASSET-LEVEL OVERVIEW

Equities & Real Estate

After experiencing a second retracement since early August, the S&P 500 Index rallied once again and made new all-time highs on September 19. Currently, tech and growth continue to lead the pack for the year, but all segments and factors remain in uptrends. Despite the persistent strength of U.S. equities, exposure in our portfolios will decrease slightly as allocations will return to other assets that have strengthened enough to receive their full strategy weight.

Foreign developed and emerging markets allocations will once again be unchanged at the beginning of October. The two international equity segments continue to move in lockstep in terms of 2024 performance. Trends over all timeframes are positive.

Real estate securities continued their bounceback, aided by a resilient economy and now-lower interest rates due to the Fed rate cut. The asset class is quite strong among the equity and quasi-equity baskets. Exposure in our portfolios returned to baseline allocation for the first time since the first quarter of this year.

Fixed Income

For the fourth straight month, both exposure and duration increased within the fixed income allocation. Trends across all timeframes are positive, and the segment continues to strengthen relative to other assets. U.S. Treasuries will remain overweight in our portfolios, while international government bonds moved to baseline allocation for the first time since February. The last time international bonds reached this level, the move was brief, and before that, it last sat at baseline allocation in January 2023.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 8/1/2024 to 9/25/2024 and Reuters, “S&P 500 surges to record high close on euphoria over Fed rate cut,” 9/19/2024

Three potential catalysts for trend changes:

-

Rate Cuts: The Federal Reserve voted to lower interest rates by a half-percentage point. Eleven of 12 Fed voters supported the cut, which brings the federal funds rate down to a range between 4.75% and 5%. Quarterly projections released by the Fed show a narrow majority of officials are open to additional cuts, which could lower rates by at least a quarter-point at each of the November and December meetings. The decision to cut rates by a larger amount than most analysts expected signals that the central bank is moving into a new phase of its battle with inflation. They are attempting to prevent past rate increases, which took borrowing costs to a two-decade high, from further weakening the U.S. labor market.

-

Rate Effects: “It’s not obvious that Fed rate cuts will have much of a soothing effect on the economy because the average interest rate that households and businesses face is going to rise even after the Fed cuts rates,” said Peter Berezin, Chief Global Strategist at BCA Research. However, the rate cuts could have a quicker real-world impact because the U.S. is at a different starting point than other rate-cutting cycles. The economy is still adding jobs and retail sales growth remains positive, with figures from the Commerce Department indicating consumer spending is growing solidly.

-

Mortgage Rates and Home Sales: U.S. home sales fell in August. Sales of previously owned homes fell 2.5% from the prior month to a seasonally adjusted annual rate of 3.86 million, according to the National Association of Realtors. This is the fifth time sales have declined in the last six months. The average rate for a 30-year fixed mortgage has dropped to 6.09%, which is the lowest level in more than a year.

Sourcing for this section: The Wall Street Journal, “Fed Cuts Rates by Half Percentage Point” 9/18/2024; The Wall Street Journal, “Lower Interest Rates Don’t Guarantee a Soft Landing,” 9/27/2024; and The Wall Street Journal, “U.S. Home Sales Slipped in August Despite Falling Mortgage Rates,” 9/19/2024

Price (Again) Predicts News

“Time, the devourer of everything.” – Ovid

Since the Federal Reserve began raising rates in 2022, the term “soft landing” has been used to describe the goal of reducing inflation without tipping the economy into recession. Now, as the fourth quarter begins, it seems not only possible but increasingly likely that this outcome is on track. Gross domestic product remains above long-term growth estimates, supported by strong consumer, capital expenditure, and government spending. Meanwhile, unemployment remains historically low. Recent Fed cuts are also expected to boost the economy by putting downward pressure on mortgage rates. In short, the data offers little support for a recession forecast.

As one might imagine, the stock market has responded positively to these developments by once again making new highs. Perhaps just as important, bond markets have also reacted favorably by making multi-year highs as they seek to recover from their great bear market of 2022. The combination of these two can create a powerful wealth effect that could further fuel growth in the economy.

Now, to someone who doesn’t closely follow the economy or financial news, this might not appear to be a big deal. However, to us, this is enormous news. It is also a reminder of just how difficult it is to predict markets given how much sentiment has vacillated between optimism and pessimism during the last few years.

One of the key attributes of trend following, which we emphasize at every opportunity, is its ability to position portfolios without relying on the inherent biases that accompany making predictions. In our view, prediction is a high-risk game — get it right, and the returns could be significant; get it wrong, and the consequences could be disastrous.

Besides the RISK of prediction is the COST of prediction. Making educated guesses requires significant cost in terms of the time and energy needed to develop any potential edge on the competition. This raises a couple of questions:

- Is it better to pursue high-risk/ high-reward, high-cost predictions?

- Or is it better to follow a system that offers more consistent, lower-risk outcomes with less cost?

To be clear, we believe the payoff of trend following will match or exceed that of a predictive approach over the long term, but even if you handicap the outcomes a bit lower, the reduction of risk and the savings of time and energy more than compensate, in our view.

While a soft landing seems to have been achieved or is imminent, it’s crucial to remember that this outcome was far from certain — and still may not be a few months from now. It’s also worth noting that the debate is far from over. Opinions have shifted frequently and likely will continue to do so for the foreseeable future.

Attempting to navigate the market uncertainty we’ve seen thus far without a fully defined system would be a gamble at best, in our view. Perhaps most importantly, even if it were possible to nail every decision using a predictive approach, the odds of repeating the outcome in different conditions would not be very slim. On the other hand, if a more passive approach was employed, one would need tremendous emotional strength to sit through the volatility with no reaction, oh, and also with the hope that the market could make a recovery.

We view a trend-following approach as the “happy medium” between the two: rooted in data, based on a repeatable system, and designed to react to actual market behavior rather than prediction or passivity. As we mention often, we feel so much more confident guiding your financial lives with an objective and repeatable process than relying on our own, often biased, perception of the market. You will always get consistency from us, and we hope that brings you great comfort.

Sourcing for this section: Reuters, “S&P 500 surges to record high close on euphoria over Fed rate cut,” 9/19/2024 and Barchart.com, US Aggregate Bond Ishares Core ETF (AGG), 1/1/2022 to 9/25/2024

Sincerely,

The Spartan Team

Disclaimer: this note is for general update purposes related to the strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your particular exposure to any given asset class will depend on your goals, risk profile, and how tactical or passive your risk profile calls for. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth please contact your advisor. This email and the data herein is not a solicitation to invest in any investment product nor is it intended to provide investment advice. It is intended for information purposes only and should be used by investment professionals and investors who are knowledgeable of the risks involved. No representation is made that any investment will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses. While every effort has been made to provide data from sources considered to be reliable, no guarantee of accuracy is given. Historical data are presented for informational purposes only. Investment programs described herein contain significant risks. A secondary market may not exist or develop for some investments portrayed. Past performance is not indicative of future performance. Investment decisions should be made based on the investors specific financial needs and objectives, goals, time horizon, tax liability, risk tolerance and other relevant factors. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Investors should consider the underlying funds’ investment objectives, risks, charges and expenses carefully before investing. The Advisor’s ADV, which contains this and other important information, should be read carefully before investing. ETFs trade like stocks and may trade for less than their net asset value. Spartan Planning Group, LLC (“Spartan” or the “Advisor”) is registered as an investment adviser with the United States Securities and Exchange Commission (SEC). Registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the Adviser has attained a particular level of skill or ability. Indexes are unmanaged and do not incur management fees, costs, and expenses. Spartan’s risk-management process includes an effort to monitor and manage risk, but should not be confused with and does not imply low risk or the ability to control risk. There are risks associated with any investment approach, and Spartan strategies have their own set of risks to be aware of. First, there are the risks associated with the long-term strategic holdings for each of the strategies. The more aggressive the Spartan strategy selected, the more likely the strategy will contain larger weights in riskier asset classes, such as equities. Second, there are distinct risks associated with Spartan Strategies’ shorter-term tactical allocations, which can result in more concentration towards a certain asset class or classes. This introduces the risk that Spartan could be on the wrong side of a tactical overweight, thus resulting in a drag on overall performance or loss of principal. International investments may involve additional risks, which could include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks. Diversification strategies do not ensure a profit and do not protect against losses in declining markets.