Price Drives Sentiment

“Without data, you’re just another person with an opinion.” –W. Edwards Deming

From July 16 to August 5, the S&P 500 experienced an 8.5% decline, culminating in a sharp 3% drop on August 5. During this period, headlines, clients, and pundits alike were quick to declare the end of the bull market. Market shocks often bring out the naysayers, ready to predict prolonged downturns. As we often say, “Price drives sentiment.” Yet, by the end of August, the volatility was largely forgotten, and the purported reasons behind it faded into the background.

When prices fall, emotions inevitably come into play. Fear, greed, and other feelings can drive many investors to act impulsively, often to the detriment of their long-term goals. While much has been written about investor psychology, we want to focus on a different concept in this Monthly Note: the importance of speed and timeframe in responding to market changes.

Every investor operates within a unique timeframe aligned with their personal goals, and each has a choice in how quickly to react to market changes. Rather than making a binary decision — being “in” or “out” — we believe a more incremental approach leads to better outcomes. Just as you would respond to the first signs of smoke differently than dancing flames, we think it’s crucial to begin adjusting exposure when early warning signs turn into evident trends. This approach allows for timely, gradual adjustments without overreacting to initial market fluctuations.

In this Monthly Note, we review the market volatility of July and August and discuss how our strategies responded. We believe that steadfastly adhering to the process, particularly during emotionally charged environments will naturally lead to more favorable outcomes over time.

But first, here’s a summary of our take on what transpired in the markets heading into September.

.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 7/16/2024 to 8/5/2024

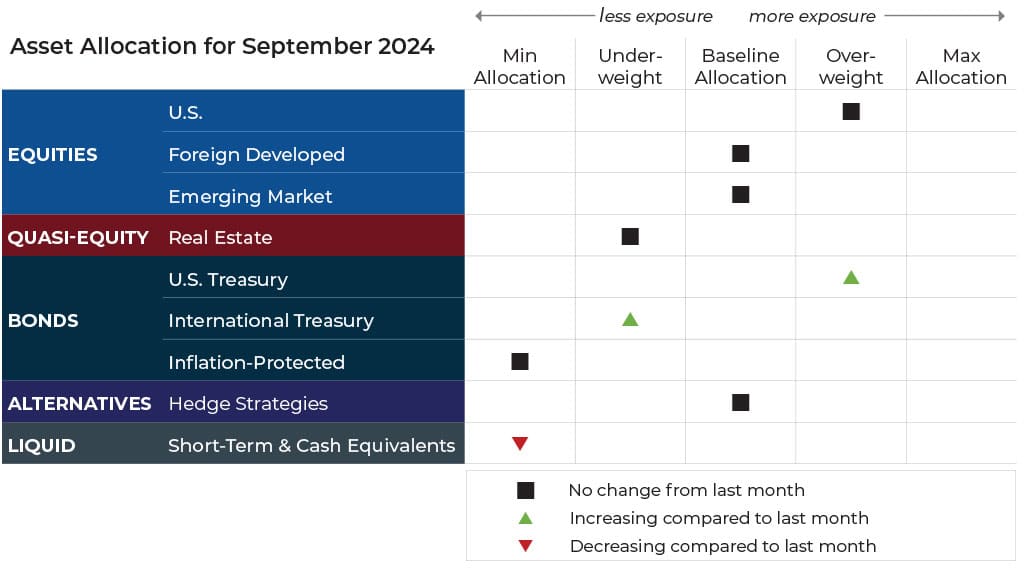

Disclaimer: This note is for general update purposes related to the general strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your exposure to any given asset class will depend on your goals, risk profile, and how tactical or static your risk profile calls for. Adjustments can vary across strategies depending on each strategy’s objectives. What’s illustrated above most clearly reflects allocation adjustments for the Growth Strategy. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth, please contact your advisor.

ASSET-LEVEL OVERVIEW

Equities & Real Estate

After a sharp drop to open August, the S&P 500 Index quickly recovered to challenge new all-time highs as the month closed. Tech and growth continued to lead the pack for the year, as they have for much of the uptrend since the start of 2023. All segments and factors remained in uptrends and, our portfolios remain overweight U.S. equities, particularly large- and mega-cap stocks.

Foreign developed and emerging markets allocations remain steady as we begin September. The two international equity segments are in a virtual deadlock in terms of year-to-date performance, but emerging markets exhibited slightly stronger trends.

Real estate securities continued to hold positive moving trends and maintained their exposure this month. However, exposure in our portfolios will continue to be capped due to the long-term weakness of this asset class compared to U.S. equities.

Fixed Income

The biggest changes in portfolios for September occurred within the fixed-income segment. With growing confidence in declining rates, values have risen, uptrends have been generated, and strength has increased. As a result, duration in our portfolios has also increased. In fact, for the first time since 2021, ultra-short-duration bonds decreased in exposure to near-minimum levels. Instead, intermediate- and even long-duration bonds have taken a significant position.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 8/1/2024 to 8/27/2024 and Barchart.com, Real Estate Vanguard ETF (VNQ), 7/1/2024 to 8/27/2024

Three potential catalysts for trend changes:

-

Rate Cutting Expected: Although economic data is mixed, Federal Reserve policymakers are likely to begin cutting rates later this month. Recent data shows continued inflation cooling, but the labor market has recently indicated weakness. Additionally, a recovery in the housing market has not materialized, even though lower mortgage rates and higher inventory have improved the buyer’s market.

-

Job Market: The job market has been weaker than previously thought. New data reflecting the period from early 2023 to early 2024 shows employers may have added 818,000 fewer jobs than originally thought during the 12 months that ended in March. That means the economy may have added 68,000 fewer jobs per month than previously reported.

-

Mortgage Rates: Mortgage rates fell to a new 15-month low, with the average rate for a standard 30-year fixed mortgage dropping to 6.35% from just under 6.5% a week earlier. Mortgage rates are more than 1% lower than the near-8% peak they reached in 2023. However, mortgage rates are still about twice what they were before the Federal Reserve started to raise interest rates in 2022.

Sourcing for this section: The Wall Street Journal, “’Soft Landing’ Gets a Boost From New Data,” 8/29/2024; The Wall Street Journal, “U.S. Job Market Was Weaker Than Previously Reported, Data Show, 8/21/2024; and The Wall Street Journal, “Mortgage Rates Fall to Lowest Since May 2023,” 8/29/2024

Post-Mortem on August’s Market Shock

“You should be far more concerned with your current trajectory than with your current results.” –James Clear

On August 5, the day the S&P 500 opened at the lowest level since early May, we received the following communication from our long-standing trade team, Blueprint Investment Partners, that will hopefully lend some helpful perspective:

“Hello everyone, in light of this morning’s market action, we wanted to pull together some data to hopefully provide some helpful context. We’ve attached a sheet showing the frequency of various levels of daily decline in the S&P 500 Index (ETF: SPY) over the last 30 years when in an uptrend (as marked by the previous day’s 10-day EMA being greater than its 100-day EMA).

The bottom line: daily declines of 2%, 3%, 4%, and even 5% will occur from time to time which means they are intrinsic (not a threat) to the system. For example, prior to today, there have been 116 occurrences of a 2% decline in a 10/100 uptrend over the last 30 years. This equates to almost 4 per year. Obviously 3, 4, and 5% declines happen less frequently but they still happen and appear to have little bearing on long-term performance.

…

No one knows what will happen and all declines can be painful, but in our opinion, the data is pretty conclusive. We will let the trends play out and make adjustments if necessary at month-end.

If you have any questions don’t hesitate to reach out. Thanks as always for your partnership!”

This communication was on the back of a poor performance for U.S. equity markets at the end of July, and right after our monthly reallocation. Interestingly enough, September is opening with a little Deja Vu. The month began with a strong position and has seen declines in the first few days. Maybe this will be a reiteration of our last month, or maybe things will look different. We don’t know, but you will always get consistency from us. A short-term outcome is not what matters in the long run – but rather the consistently disciplined response that guides you through them. We’ve said before, “Trend following does not win every time, but gives you the best opportunity to win over time.”

The same lessons and benefits of a trend-following approach apply to what is happening with fixed income. It is reasonable to believe bond prices could recover as the Fed embarks on its next rate-cutting cycle, but when will they recover, and how fast? In keeping with our philosophy, we wouldn’t dare predict. All we know is our systematic investing process has recommended a significant change to how we have been exposed to bonds for the last couple of years. Ultra-short-duration bonds have been a major portion of our portfolios for this period, but this allocation will now be placed on the back burner. It takes conviction or a system — and maybe both — to enact such a big shift.

As we constantly repeat, for us there is tremendous comfort and confidence in having a rules-based, data-centric approach. We don’t know what will happen, but we know exactly how we will respond to the reality of the marketplace, as the data makes it known. There is no other way we would want to help steward you toward your long-term goals, than with an objective and disciplined approach.

Sourcing for this section: Barchart.com, S&P 500 Index ($SPX), 5/1/2024 to 8/27/2024

Sincerely,

The Spartan Team

Disclaimer: this note is for general update purposes related to the strategy and approach of Spartan Planning portfolios. Every client’s situation including Risk Profile, Time Horizon, Contributions, and Distributions is different from other clients. Your particular exposure to any given asset class will depend on your goals, risk profile, and how tactical or passive your risk profile calls for. If there have been changes to your risk profile and/or goals or if you wish to discuss them in more depth please contact your advisor. This email and the data herein is not a solicitation to invest in any investment product nor is it intended to provide investment advice. It is intended for information purposes only and should be used by investment professionals and investors who are knowledgeable of the risks involved. No representation is made that any investment will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses. While every effort has been made to provide data from sources considered to be reliable, no guarantee of accuracy is given. Historical data are presented for informational purposes only. Investment programs described herein contain significant risks. A secondary market may not exist or develop for some investments portrayed. Past performance is not indicative of future performance. Investment decisions should be made based on the investors specific financial needs and objectives, goals, time horizon, tax liability, risk tolerance and other relevant factors. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Investors should consider the underlying funds’ investment objectives, risks, charges and expenses carefully before investing. The Advisor’s ADV, which contains this and other important information, should be read carefully before investing. ETFs trade like stocks and may trade for less than their net asset value. Spartan Planning Group, LLC (“Spartan” or the “Advisor”) is registered as an investment adviser with the United States Securities and Exchange Commission (SEC). Registration does not constitute an endorsement of the firm by the SEC nor does it indicate that the Adviser has attained a particular level of skill or ability. Indexes are unmanaged and do not incur management fees, costs, and expenses. Spartan’s risk-management process includes an effort to monitor and manage risk, but should not be confused with and does not imply low risk or the ability to control risk. There are risks associated with any investment approach, and Spartan strategies have their own set of risks to be aware of. First, there are the risks associated with the long-term strategic holdings for each of the strategies. The more aggressive the Spartan strategy selected, the more likely the strategy will contain larger weights in riskier asset classes, such as equities. Second, there are distinct risks associated with Spartan Strategies’ shorter-term tactical allocations, which can result in more concentration towards a certain asset class or classes. This introduces the risk that Spartan could be on the wrong side of a tactical overweight, thus resulting in a drag on overall performance or loss of principal. International investments may involve additional risks, which could include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks. Diversification strategies do not ensure a profit and do not protect against losses in declining markets.